BREXIT dividend for the North Sea RORO Corridor

- By Chris Rowland

- •

- 06 Mar, 2023

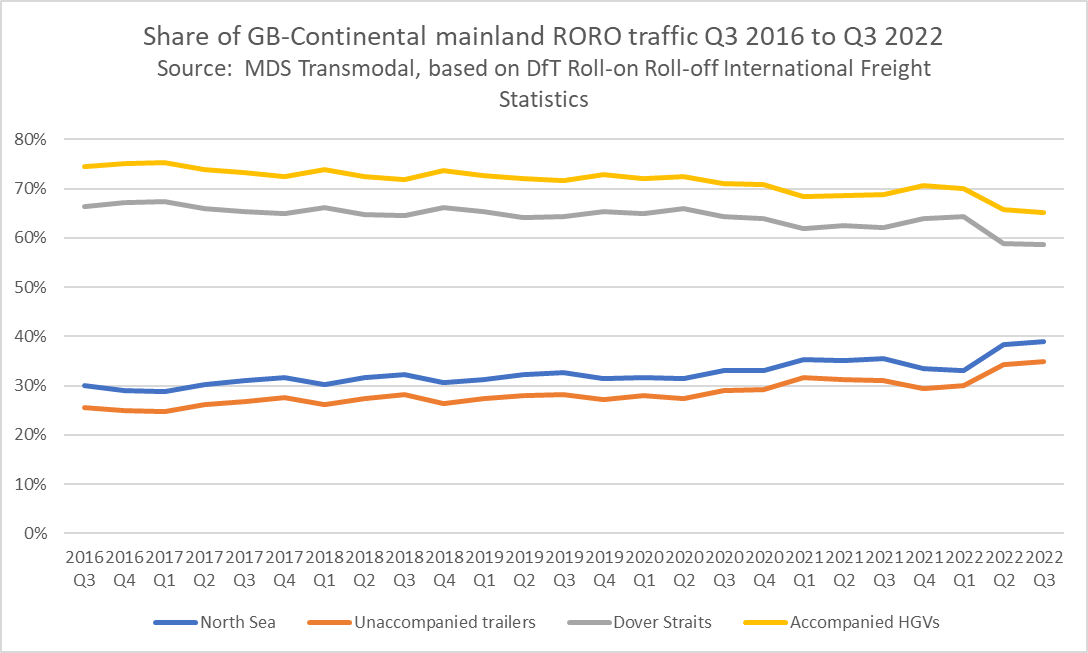

While the UK’s Office of Budget Responsibility has confirmed that “Brexit has had a significant adverse impact on UK trade…”, the North Sea RORO corridor seems to have enjoyed a Brexit dividend since 2016. Trade transported between Great Britain and the European continental mainland has gradually been shifting away from accompanied HGVs on the Short Straits to unaccompanied trailers on the North Sea since the Brexit Referendum in 2016. Quarterly RORO data published by the UK Department for Transport (DfT) shows that the unaccompanied RORO share has reached 39% of the market in Q3 2022 compared to only 30% in Q3 2016.

As the North Sea routes are

generally focused on transporting unaccompanied trailers, it’s these routes

that are benefiting from the growth in market share as shippers and freight

forwarders have moved a proportion of their volume away from the high frequency

turn-up-and-go services offered by the ferry operators and the Eurotunnel

Freight Shuttle on the Short Straits.

This is something of a

Brexit dividend for the North Sea unaccompanied RORO operators such as

Cobelfret, DFDS and Stena Line, as shippers and their logistics suppliers have

redesigned their supply chains due to the additional checks necessitated by the

UK’s Free Trade Agreement with the EU; the friction at the borders caused by

these checks has damaged the economics of faster-moving accompanied road

haulage.

But it’s not just about

Brexit. The Dover Strait was

particularly cost competitive because of the use by EU exporters of relatively

cheap Eastern European road haulage. With

average wages in Poland increasing by about 60% since 2016, Eastern European

haulage has become more expensive and, in addition, the implementation of the

EU Mobility Package in early 2022 has effectively outlawed the practise of

basing Eastern European trucks and drivers in Western Europe.

Finally, P&O Ferries’

decision to sack a large proportion of its workforce, which then led to

regulatory attention from the British Government, resulted in a significant

reduction in service capacity on the Dover-Calais route; with their direct

competitors on the corridor unable to accommodate all the traffic, the Dover

Straits’ market share slumped from 64% in Q1 2022 to 59% in Q2 and Q3 2022.

This gradual shift away from the Dover Straits to the unaccompanied RORO routes on the North Sea is not just providing a dividend for the relevant operators. It’s also likely to be providing wider environmental and economic benefits as it reduces HGV miles in Great Britain on the relatively congested road network in the South East of England.