Blog Post

Diversions from the Red Sea: Impact on Markets, Large Ships and Ports

- By MDS Transmodal

- •

- 20 Dec, 2023

There have been a number of estimates made as to the impact of current disruptions to container services as a consequence of security concerns in the Red Sea, specifically around the Bab al-Mandab Straits.

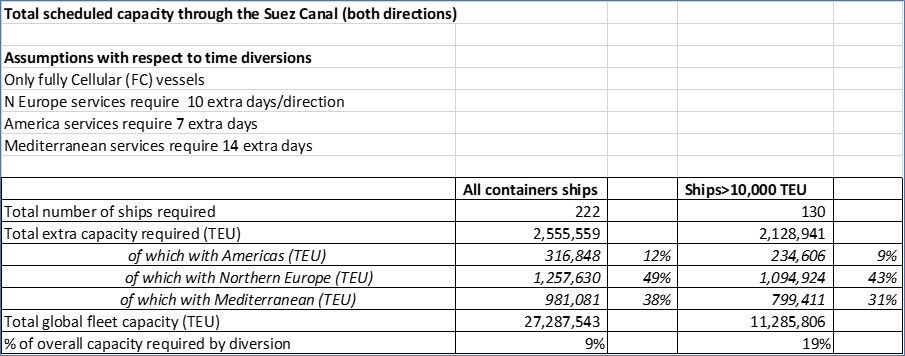

At this stage, the length of time these disruptions will continue cannot be known. However, the impact of disruptions during the Covid-19 period will be fresh in shippers’ minds and it is therefore useful to consider how flexibly and competitively the global liner service suppliers will be able to deal with the situation. The disruption does not impact different markets equally. In the table below, we have broken down the impact into the three basic service routes, namely between Asia and North Europe, the Mediterranean and the Americas, and attributed extra time at sea to each route and distinguished the size of ship sailing on each scheduled service.

If we simply take the extra demand for ship assets, we arrive at a figure of around an extra 2.5 million tweny-foot equivalent units (TEU) of capacity, which amounts to around 9% of total global fully cellular fleet capacity. This is substantial but given that freight volumes have grown so little over the last 2-3 years while the fleet has been expanding this might be an impact that can be absorbed and competition between lines will keep rates in check.

Perhaps more serious, however, could be the impact on ports. On the one hand, some ports will suddenly find themselves at a severe disadvantage because instead of being on the main global maritime highway they will find themselves almost cut off. While the current security emergency may be resolved quite shortly, there maybe a loss of confidence in the current routeing strategies and the transhipment networks that underpin them. Essentially, the issue of resilience arises again. The impact on Suez Canal revenues will be serious.

On the other hand there may well be short-term supply chain management issues as container ships delayed from Asia have then to deliver containers to ports otherwise ‘cut-off’ and which have not passed via transhipment ports where containers would have been exchanged ‘en-route’, again affecting resilience.

Share

Tweet

Share

Mail

© Copyright 2023 MDS Transmodal. All Rights Reserved.