Rail Freight Growth Target

- By Mike Hatfield

- •

- 03 Aug, 2022

Under Great British Railways (GBR), the proposed new public rail body, rail freight will remain largely in the private sector, though the Williams-Shapps Plan states that the sector will benefit from national coordination and a new rules-based access system. GBR will have a duty to promote rail freight. There is also a Government commitment to set a national rail freight growth target, as has already been done in Scotland, and the GBR Transition Team (GBRTT) has been asked by the Secretary of State to develop a range of growth target options. To inform this process, on 5 July 2022 the GBRTT published its Rail Freight Growth Target Call for Evidence.

The purpose of the Call for

Evidence is to develop an understanding of how much of the current and future

market demand for freight could be met by rail.

To understand the realistic scope for modal shift to rail, GBR needs to

develop an understanding of the:

1. Volume of goods that could be moved

by rail;

2. Where the potential for future rail freight traffic exists;

3. Where suppressed demand exists on the rail network; and

4. Where further work is needed to establish new rail terminals.

The Call for Evidence document

notes that GBR’s current understanding of rail freight growth is derived from

industry demand forecasts produced by MDS Transmodal for Network Rail in

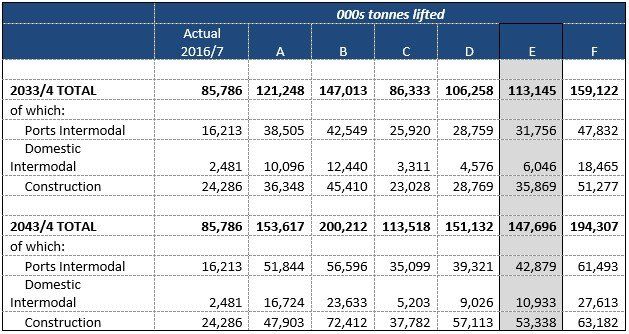

2020. Six scenarios (A-F) were

undertaken reflecting a range of growth and economic factors, Scenario E being

the ‘central’ forecasts. The table below

summarises the headline outputs and for three key sectors (central Scenario E

highlighted).

Responses to the ‘Call for Evidence’ will be used to supplement this current understanding. Consultees are being asked to provide information through a series of questions, divided into two parts. Part One is aimed at logistics operators (whether or not they use rail freight currently), with Part Two directed at wider stakeholders both inside and outside the rail sector.

Why set a rail freight growth target?

According to the consultation document,

a rail freight growth target will give GBR and the rail freight operating

companies (FOCs) a focal point around which the sector can unite. This common objective for the sector is

intended to drive “positive cultural behaviour and structural changes” that

will ensure more freight is moved by rail.

The setting of targets is a

well-used and understood management technique to both sustain and enhance

performance in a business or organisation.

In the rail sector, the most commonly known are those which relate to train

punctuality and reliability (so called Public Performance Measures or PPMs). The reasons presented in the GBRTT document

appears to conform with the main rationale for setting such targets. They will provide goals which all employees,

FOCs and suppliers can work towards.

They can help direct or focus management time and processes. They can also assist in measuring the success

or otherwise of changes to management structures and capital investment; is the

investment in new infrastructure or equipment resulting in the desired

outcomes?

What needs to happen for targets

to be achieved?

For targets to be achieved (and

exceeded), the following criteria need to be met:

1. Targets are realistic and

deliverable. There is no need to go into

detail here, but targets which from the outset are obviously not realistic or

deliverable are not worth adopting.

2. They receive ‘buy-in’ from those concerned, both within the primary organisation (such as management and workforce), and from wider stakeholders with a direct interest. Linked to the first criteria above, unrealistic targets will generally fail the ‘buy-in’ test.

3. The right commercial and management structures are in place. This will include having good quality management in place to focus minds and drive through any necessary changes to deliver the targets.

4. The required capital investment is made in the right infrastructure, facilities and equipment.

Even where the four criteria are met in full, there is always the risk that ‘events’ beyond the control of all concerned will result in targets not being achieved.

Will the rail freight growth targets be achieved?

It would appear from the Call for Evidence document that the first two criteria stand a good chance of being met. MDS Transmodal’s existing rail freight demand forecasts (which went through an industry consultation process before publication) alongside the new information now being sought should ensure that the growth target options which eventually emerge are both realistic and have ‘buy-in’ from FOCs and shippers alike.

However, the jury is still out with regards to the third and fourth criteria. The Williams-Shapps Plan promised that GBR would be a new organisation “not bound by the cultures or approaches of Network Rail or any other existing organisation in the sector” and that a significant number of senior management roles should have experience outside Network Rail. GBR does not yet formally exist, the management structures (and its culture) with respect to freight have yet to be defined and its senior management team has yet to be appointed. We cannot therefore be certain at this stage whether the right commercial and management structures/personnel will be in place that can deliver the target.

It is also clear that investment in new infrastructure and equipment will be required to deliver significant growth on rail freight. Modelling work by MDS Transmodal for the DfT and the sub-national transport bodies indicates that a number of junction ‘pinch-points’ are already supressing growth. Investment will be needed to provide capacity enhancing solutions if any future growth target is to be delivered. However, GBR’s future enhancement budget for freight has yet to be quantified and the Rail Network Enhancements Pipeline has not been updated for over three years.

Private sector investment is forthcoming. A number of new SRFIs have recently been granted consent (e.g. Northampton Gateway, West Midlands Interchange) and construction has commenced. New bi-mode freight locomotives are on order and wagon leasing companies are also known to be ready to invest in new rolling stock. However, such funders will need confidence to invest further, and that decision will, in-part, be based on the Government/GBR’s willingness to fund and deliver the necessary infrastructure enhancements.

Overall, the decision to adopt a rail freight growth target is to be welcomed. However, it remains to be seen whether any targets will be delivered given the uncertainty over GBR’s future management structure and capital funding.