Rail freight : Market trends in three graphs

- By Mike Hatfield

- •

- 05 Dec, 2019

Rail freight in Great Britain appears, at first sight, to be in terminal decline. However, the rapid decline in coal traffic since 2013-14 as a result of energy policy has hidden the continuing success of the rail freight sector in handling more intermodal and construction traffic.

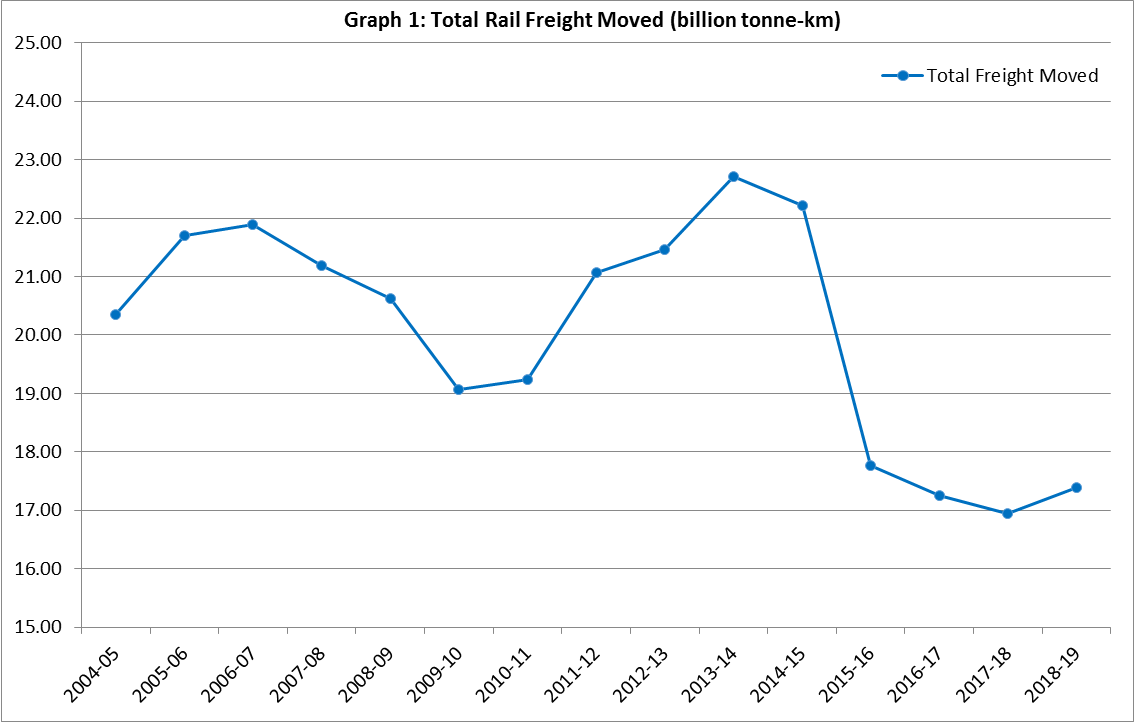

Graph 1 shows total freight moved by rail in Great Britain from 2004-05 to 2018-19.

Source: Office of Rail and Road (ORR)

Taken at face-value, the graph would appear to suggest that rail freight is a declining sector. From a peak of 22.7 billion tonne-km in 2013-14, freight moved by rail fell to 17.4 billion tonne-km in the latest full financial year (2018-19). Graph 2 below, however, provides the explanation for this apparent trend.

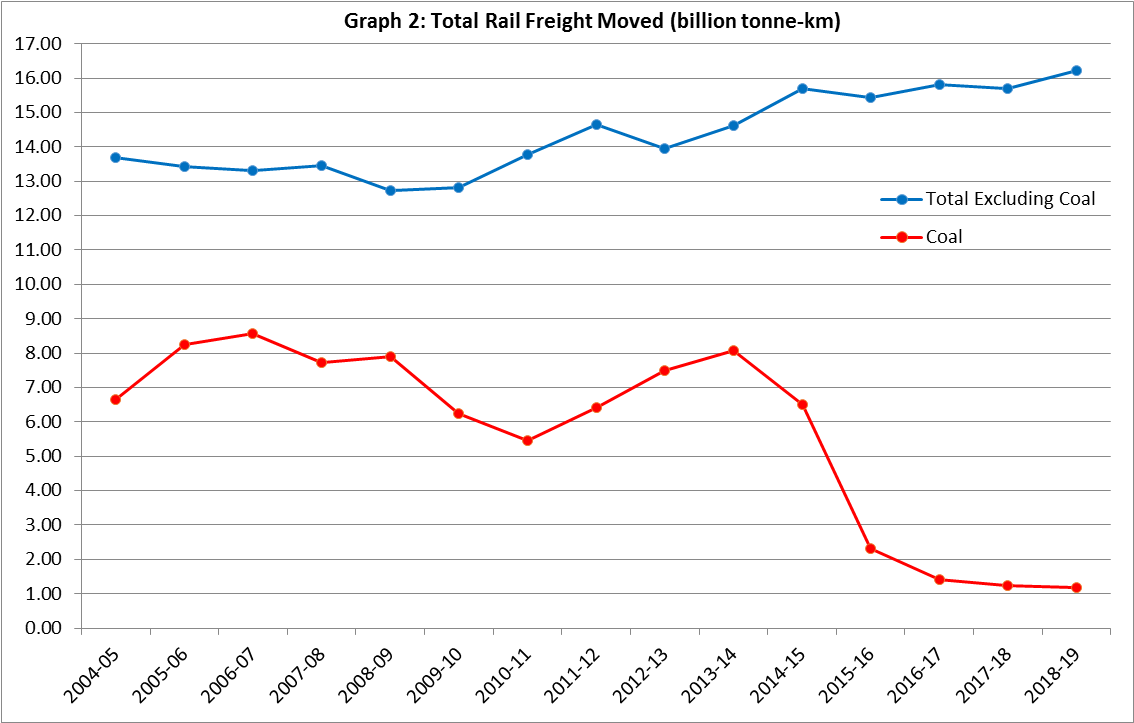

Source: Office of Rail and Road (ORR)

The blue

line in Graph 2 shows total freight moved by rail in Great Britain from 2004-05

to 2018-19, albeit excluding coal. It

shows that from a low point of 12.7 billion tonne-km in 2008-9, rail freight

moved excluding coal gradually increased to 16.2 billion tonne-km by

2018-19. The red line in Graph 2 shows

coal moved by rail freight in Great Britain over the same period, which fell

from 8.1 billion tonne-km in 2013-14 to just over 1 billion tonne-km in 2018-19. The overall market fall is therefore

explained by this dramatic reduction in coal moved, principally coal supplied

to the Electricity Supply Industry (ESI).

This is due to European emissions legislation and Government policy to

phase out electricity generated from coal, which has resulted in many

coal-fired power stations closing and a consequent reduction in the use of

steam coal for electricity generation.

Within a few years no ESI coal will be distributed.

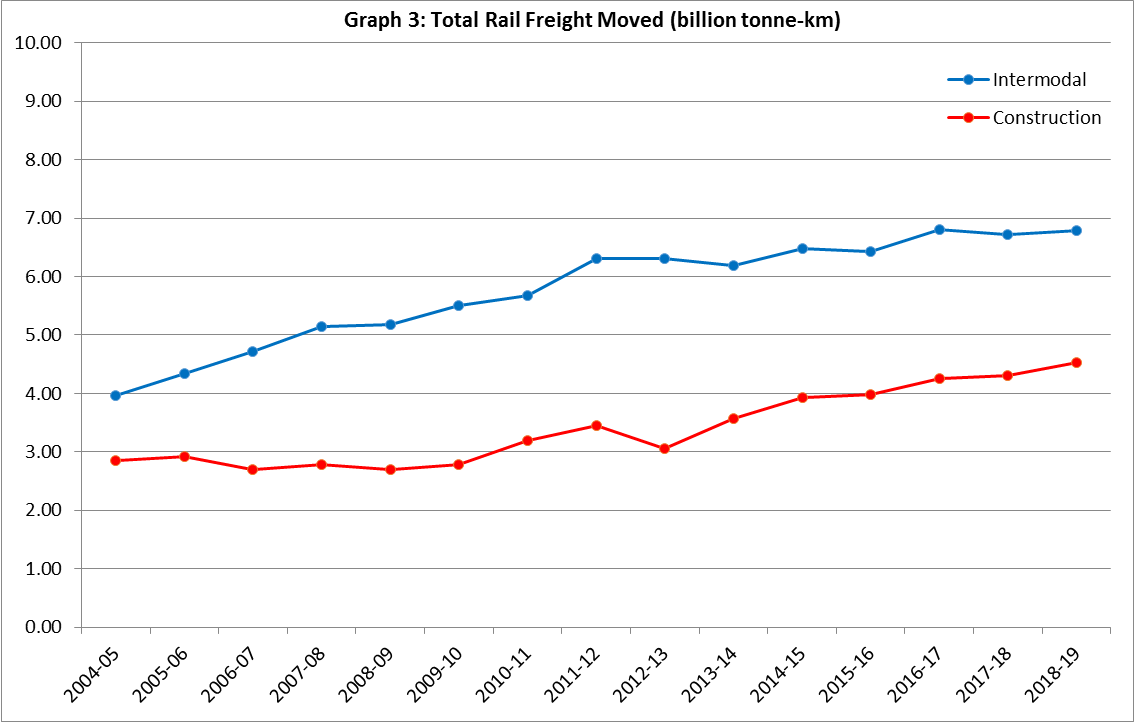

The underlying market growth

(excluding coal) has principally been driven by two key commodity groups,

namely construction materials and intermodal. This is shown in Graph 3 below.

Combined these two commodity groups now account for 65% of goods moved by rail

(the equivalent figure in 2004-05 was 34%).

Building activity has recovered since the 2008-09 financial crisis,

while at the same time rail has benefitted from an increased concentration on

rail-linked ‘super quarries’ in the Midlands and Mendips, replacing locally

sourced materials in the South East.

Intermodal traffic has expanded because:

- A growing proportion of consumption is satisfied by imports, which often arrive in maritime containers through rail-linked ports;

- Road haulage costs are rising (fuel and driver wage rises), while at the same time rail freight has become more fuel and labour efficient through using longer trains; and

- Rail-linked distribution parks have been developed (and are continuing to be developed), thereby reducing the costs associated with transferring cargo from rail to storage and onward redistribution.

Source: Office of Rail and Road (ORR)