VIEWPOINT - OTHER

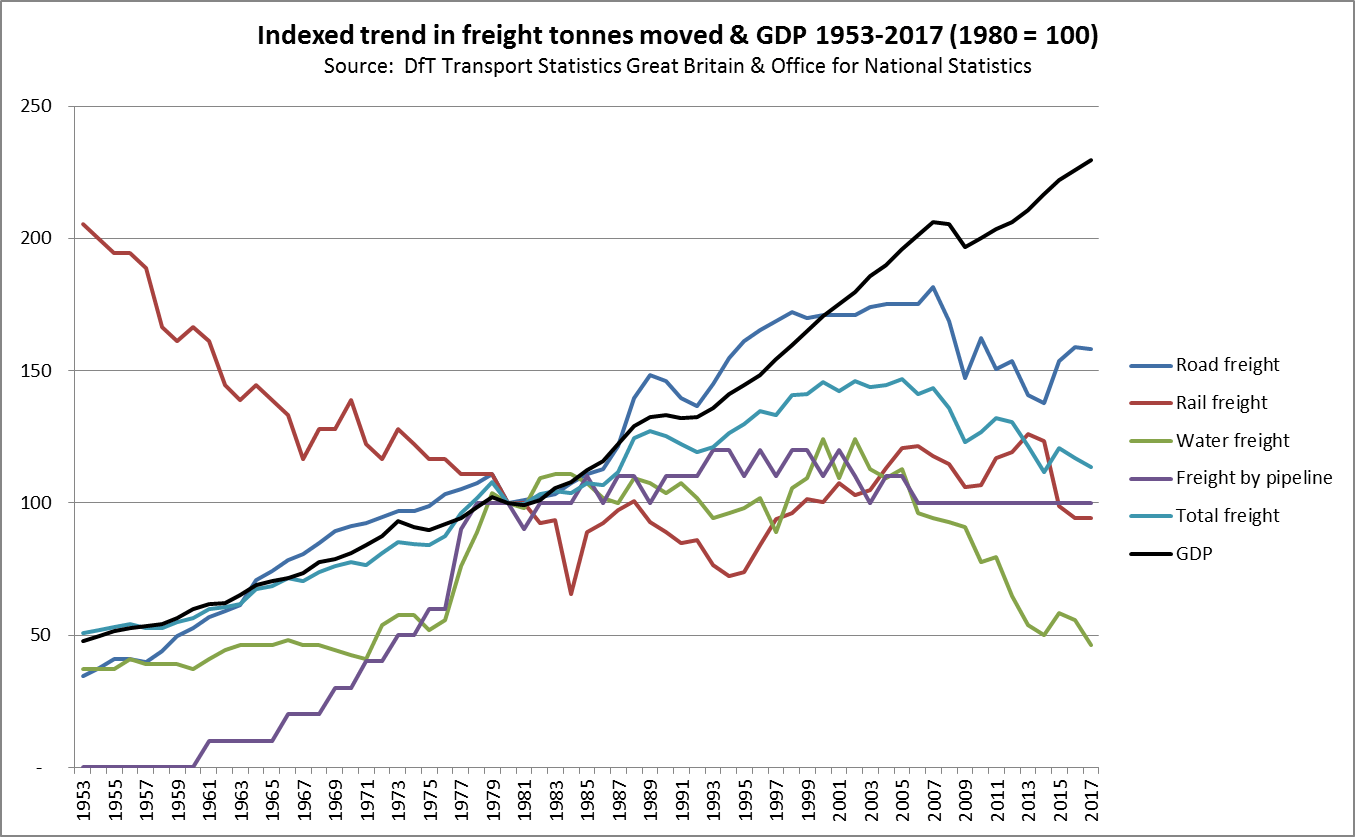

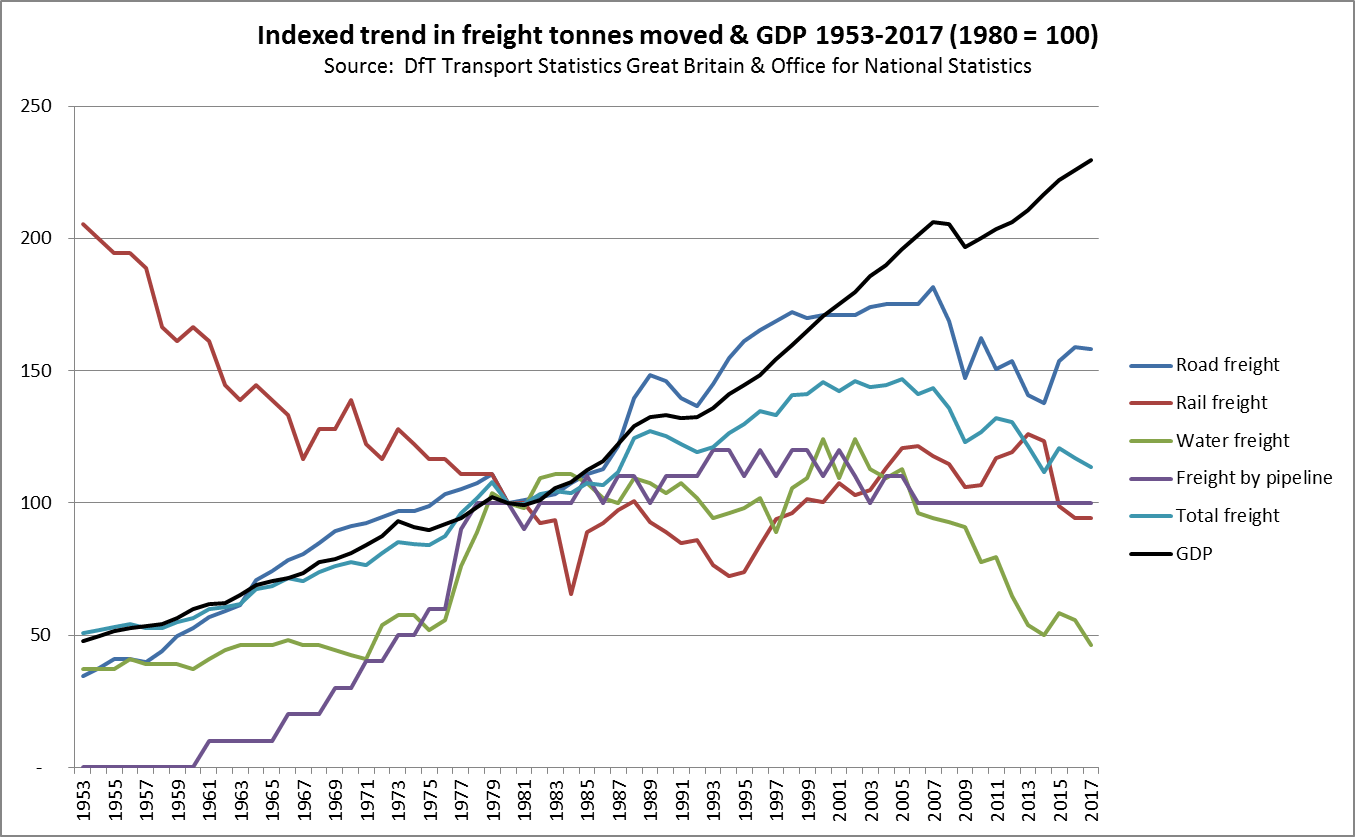

There has been a gradual de-coupling of freight moved or lifted from GDP growth since the early 1980s due to the decline of heavy industry and manufacturing generally and a shift to a service-based economy that is more reliant on imports of consumer goods. This trend accelerated following the Great Recession in 2008-09.

Free Trade Zones (FTZs) are not a new concept in the UK, but have received more attention in recent months as they are one of the opportunities that could emerge for UK ports following a likely ‘hard Brexit’ where the UK will leave both the Single Market and the Customs Union.

Between 1983 and 1988 the UK established FTZs at three ports and three airports, but the concept was of little practical use once the Single Market came into force in 1993. The FTZ concept in the UK involved providing manufacturers and logistics providers with permission to import, store and add value to goods within a designated area at a port or airport and then re-export them without the payment of UK import tariffs. Goods for UK domestic consumption could also be stored in the FTZ and tariffs or other taxes were only payable when the goods were physically moved outside the free zone.

The FTZ concept could therefore be introduced once the UK has left the EU in March 2019 to encourage inward investment by global manufacturing companies and logistics providers at UK ports and airports. However, these companies would consider the overall costs of an individual FTZ before re-locating there. This would include not only the tariff and taxation advantages but also land rental and labour costs and the costs of transport on a door-to-door basis compared to their existing arrangements. In general terms, an FTZ would be competitive in two main situations:

- For processing

semi-finished goods before export to the EU or elsewhere, particularly where

there are inverted tariffs applied in the export markets; this is where the

semi-finished goods incur higher tariffs than the finished goods.

- To store finished consumer goods before delivery to the rest of the EU or elsewhere and therefore provide a cash flow advantage from tax-free storage.

The competitiveness of an individual port- or airport-based FTZ would be related to:

- The geographic

location of the port or airport in relation to the source of the inbound goods

and the final overseas markets;

- Access to a

network of unitload transport services serving the relevant markets;

- Access to a

cost-effective land bank for the construction of factories and distribution

centres;

- Access to labour.

These ports or airports would be in competition with locations that are currently competitive for these activities in the EU, principally the Benelux area for European Distribution Centres, and major manufacturing locations in the EU for manufacturing, processing or assembly. UK ports and airports might be able to offer lower rental and labour costs compared to the Benelux area and Germany, but would be more remote from the major markets in NW Europe; having said that, as the UK has traditionally been a net importer from the EU, goods being transported from the UK to the Near Continent would enjoy cheaper backload rates. The key issue is likely to be the extent which transport costs to/from EU markets offset the tariff and taxation advantages of a location within an FTZ.

As the negotiations between the UK Government and the European Commission get started following the UK General Election on 8th June – which is expected to give Mrs May a large parliamentary majority – FTZs are one of the opportunities that may be available for UK ports after Brexit.

SERVICES

There has been a gradual de-coupling of freight moved or lifted from GDP growth since the early 1980s due to the decline of heavy industry and manufacturing generally and a shift to a service-based economy that is more reliant on imports of consumer goods. This trend accelerated following the Great Recession in 2008-09.

Free Trade Zones (FTZs) are not a new concept in the UK, but have received more attention in recent months as they are one of the opportunities that could emerge for UK ports following a likely ‘hard Brexit’ where the UK will leave both the Single Market and the Customs Union.

Between 1983 and 1988 the UK established FTZs at three ports and three airports, but the concept was of little practical use once the Single Market came into force in 1993. The FTZ concept in the UK involved providing manufacturers and logistics providers with permission to import, store and add value to goods within a designated area at a port or airport and then re-export them without the payment of UK import tariffs. Goods for UK domestic consumption could also be stored in the FTZ and tariffs or other taxes were only payable when the goods were physically moved outside the free zone.

The FTZ concept could therefore be introduced once the UK has left the EU in March 2019 to encourage inward investment by global manufacturing companies and logistics providers at UK ports and airports. However, these companies would consider the overall costs of an individual FTZ before re-locating there. This would include not only the tariff and taxation advantages but also land rental and labour costs and the costs of transport on a door-to-door basis compared to their existing arrangements. In general terms, an FTZ would be competitive in two main situations:

- For processing

semi-finished goods before export to the EU or elsewhere, particularly where

there are inverted tariffs applied in the export markets; this is where the

semi-finished goods incur higher tariffs than the finished goods.

- To store finished consumer goods before delivery to the rest of the EU or elsewhere and therefore provide a cash flow advantage from tax-free storage.

The competitiveness of an individual port- or airport-based FTZ would be related to:

- The geographic

location of the port or airport in relation to the source of the inbound goods

and the final overseas markets;

- Access to a

network of unitload transport services serving the relevant markets;

- Access to a

cost-effective land bank for the construction of factories and distribution

centres;

- Access to labour.

These ports or airports would be in competition with locations that are currently competitive for these activities in the EU, principally the Benelux area for European Distribution Centres, and major manufacturing locations in the EU for manufacturing, processing or assembly. UK ports and airports might be able to offer lower rental and labour costs compared to the Benelux area and Germany, but would be more remote from the major markets in NW Europe; having said that, as the UK has traditionally been a net importer from the EU, goods being transported from the UK to the Near Continent would enjoy cheaper backload rates. The key issue is likely to be the extent which transport costs to/from EU markets offset the tariff and taxation advantages of a location within an FTZ.

As the negotiations between the UK Government and the European Commission get started following the UK General Election on 8th June – which is expected to give Mrs May a large parliamentary majority – FTZs are one of the opportunities that may be available for UK ports after Brexit.