Brexit & Ireland: De-integration of Ireland's economy from Great Britain

- By Chris Rowland

- •

- 24 Jan, 2024

While Britain remains Ireland’s most important trading partner, trade statistics suggest that, after Brexit, Ireland is gradually switching its inbound supply chains away from Great Britain and towards the rest of the European Union.

Ireland’s economy and supply chains have been integrated with those of Great Britain for many years. This was due to the physical proximity of, and cultural links between, the two countries, combined with both being within the EU’s Customs Union and Single Market, so that administrative procedures related to trade were minimised. This allowed major retailers to serve their Irish retail outlets from distribution centres in the north of England, taking advantage of frequent overnight RORO services across the Irish Sea, particularly between Holyhead/Liverpool and Dublin.

The departure of

Great Britain (if not Northern Ireland) from the EU’s Customs Union and Single

Market on 31st December 2020 led to the overnight introduction of

customs procedures and other administrative checks on goods imported into

Ireland from Great Britain. This was

because, although the UK is just about to start introducing checks on imported

goods from the EU from 31st January 2024, Ireland was required under

EU rules to introduce checks on imports from Great Britain straightaway. As Northern Ireland remained in the Single

Market for goods and the Customs Union, trade across the land border should not

have been affected to any significant extent.

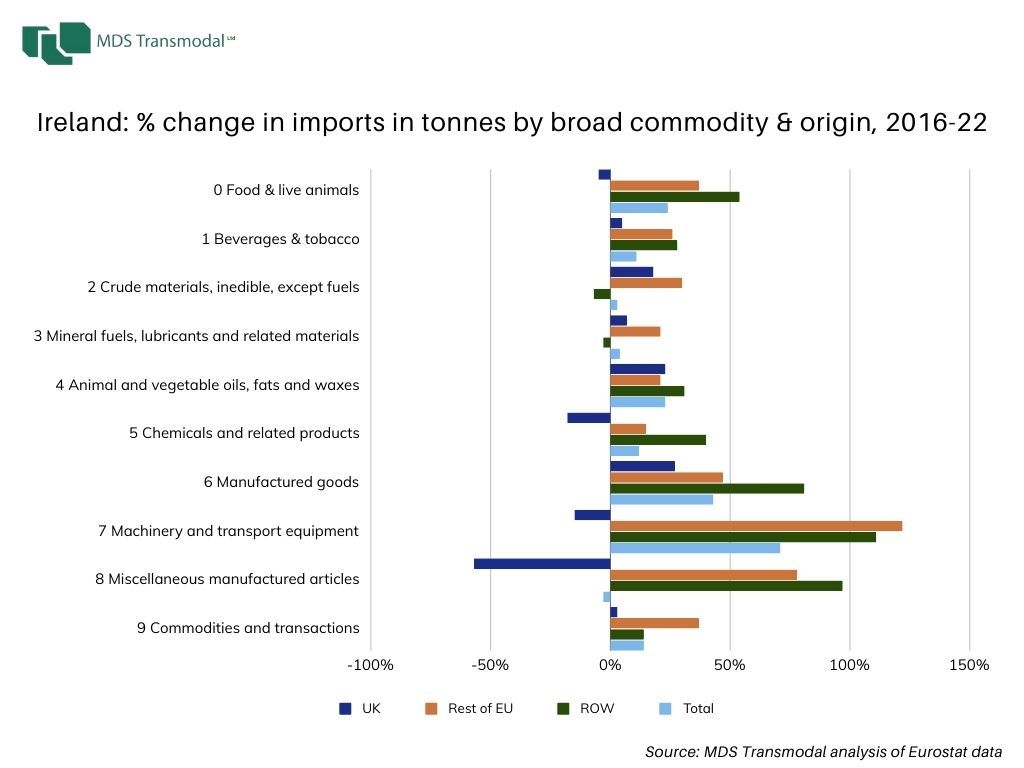

Excluding trade in bulk energy goods, which can distort trade volumes, Ireland’s total imports of physical goods increased from 25.0 million tonnes in 2016 – when the UK voted to leave the EU - to 29.7 million tonnes in 2022. While imports from the UK represented 38% of the total in 2016, they were only 32% in 2022, whereas imports from the rest of the EU have increased from 25% to 30% of the total over the same period. This suggests that, although the UK remains the largest single source of imports and trade across the Irish land border is largely unaffected, Ireland’s economy may be beginning to de-integrate with that of Great Britain, with Irish companies choosing to source a greater proportion of their goods directly from the continental mainland rather than via Great Britain.

The effect of Brexit on Ireland’s imports from the UK are even clearer at the level of broad commodity groups as shown in the above chart. This shows the percentage change in goods traded in tonnes by broad commodity between 2016 and 2022 for imports from the UK, from the rest of the EU, the rest of the world and in total. This suggests that in almost every category, but particularly in categories such as food, manufactured goods, machinery and transport equipment, imports from the UK have either fallen or grown at a slower rate than the rest of Europe and the rest of the world.