Decarbonisation: The Zero Emission Vehicle Mandate for freight transport

- By Chris Rowland

- •

- 24 Jan, 2024

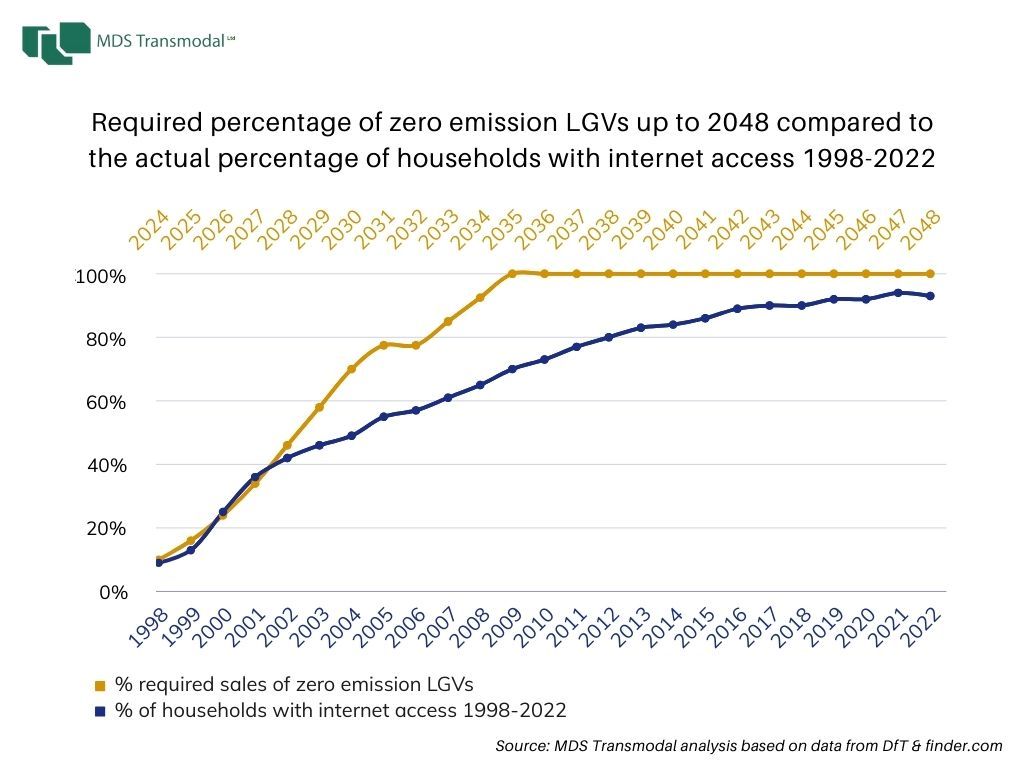

The Zero Emission Vehicle Mandate provides a strong financial incentive for manufacturers to sell a rapidly increasing proportion of zero emission vehicles up to 2030 - when 70% of all LGVs sold must be zero emission. This will require market uptake of zero emission LGVs at a rate similar to that for internet access in households at the turn of the century.

The UK is required by the Climate Change Act and various international treaty obligations to achieve net zero greenhouse gas (GHG) emissions by 2050, and the road freight sector will have a key role to play in achieving that target despite it being regarded as a sector that is hard to decarbonise.

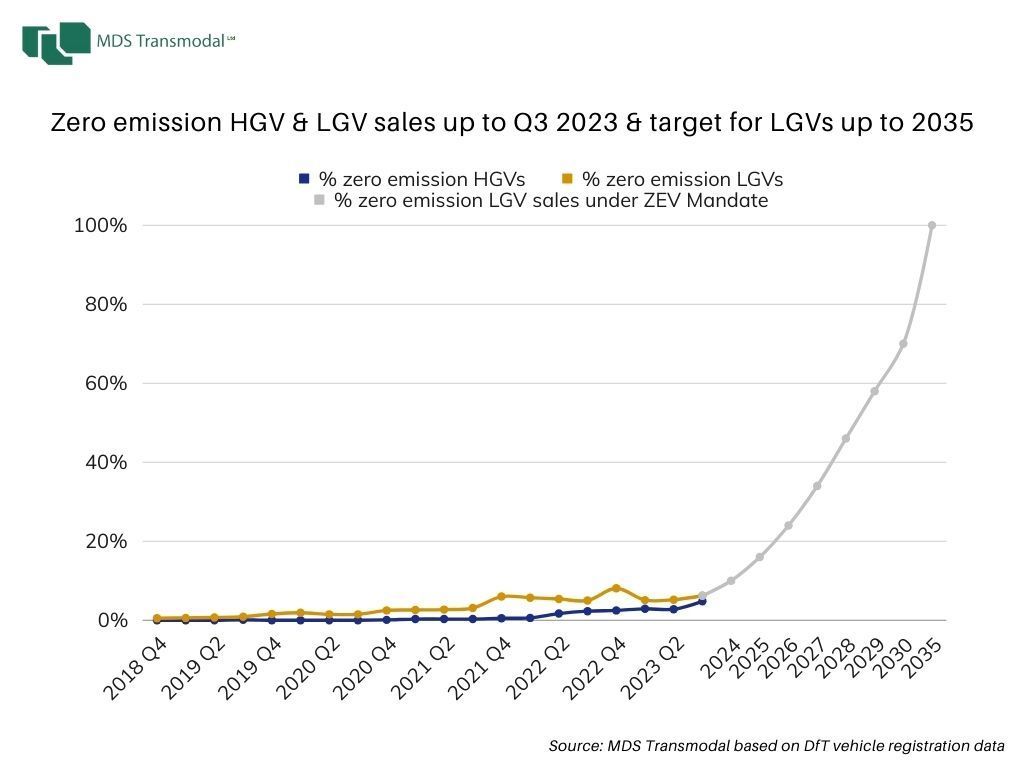

The emerging consensus in the UK is that zero-emission light goods vehicles (LGVs, with a gross vehicle weight of 3.5 tonnes or less) will utilise battery-electric technology, supported by an expanded fast-charging network. While the UK Government has pushed back the deadline for all LGVs being required to be zero emission to 2035, the Zero Emission Vehicle Mandate requires 70% of vehicles sold in 2030 to be zero emission, and with intermediate targets for each year up to that date. As only 6% of all new LGVs sold in Q3 2023 were zero emission (mainly battery-electric), a target of 70% by 2030 appears to be quite challenging for the manufacturers.

In contrast, there is a significant degree of uncertainty about exactly how heavy goods vehicles (HGVs, with a gross vehicle weight of over 3.5 tonnes) will be decarbonised and no single technological solution (or multiple solutions) has yet to emerge which has the necessary ‘buy-in’ from both Government and industry. Despite this uncertainty, the UK Government is planning to ban the sale of pure diesel HGVs from 2035 (up to 26 tonnes gross vehicle weight) and 2040 (all HGVs) and is therefore assuming that a consensus will emerge in the next few years. In reality in Q3 2023 about 5% of all new HGVs sold were zero emission and almost all of these were battery-electric, which shows how the market is developing for what are (mainly) likely to be smaller rigid HGVs used mainly for deliveries and collections in urban areas.

Can these challenging targets be achieved in practice? Are there examples of the take-up of technology at a similar rate in recent history? Such high growth rates have been achieved in the relatively recent past, but in quite different markets. The following chart shows the take-up of internet connections by households in the UK from 1998 to 2022 compared to the growth targets for sales of LGVs over the same 24 year period from 2024 to 2048. It highlights how the required growth rates for sales of LGVs up to 2028 follows the same trajectory as actual sales of internet connections to households in the period 1998-2002, before needing to grow at an even faster rate.

While take-up of internet access (a B2C market) in the late 1990s and early 2000s was based on high levels of private sector investment by the telecoms sector, with regulatory support, to meet strong consumer demand, growth in sales of LGVs (a B2B market) will require high levels of private sector investment by both operators and manufacturers with very strong regulatory incentives (particularly for manufacturers) to encourage sales.