Red Sea attacks prompt 2m teu drop in Suez boxship traffic

- By MDS Transmodal in Lloyd's List

- •

- 12 Jan, 2024

Maersk was the most active box carrier through the Suez before its recent decision to pause transits.

Liner capacity through the Suez down some 60% across the New Year period, as carriers show unified response to Houthi threat.

The rerouting of container shipping services in response to Houthi attacks in the Red Sea led to a near 2m teu drop in fleet capacity heading through the Suez over the new year.

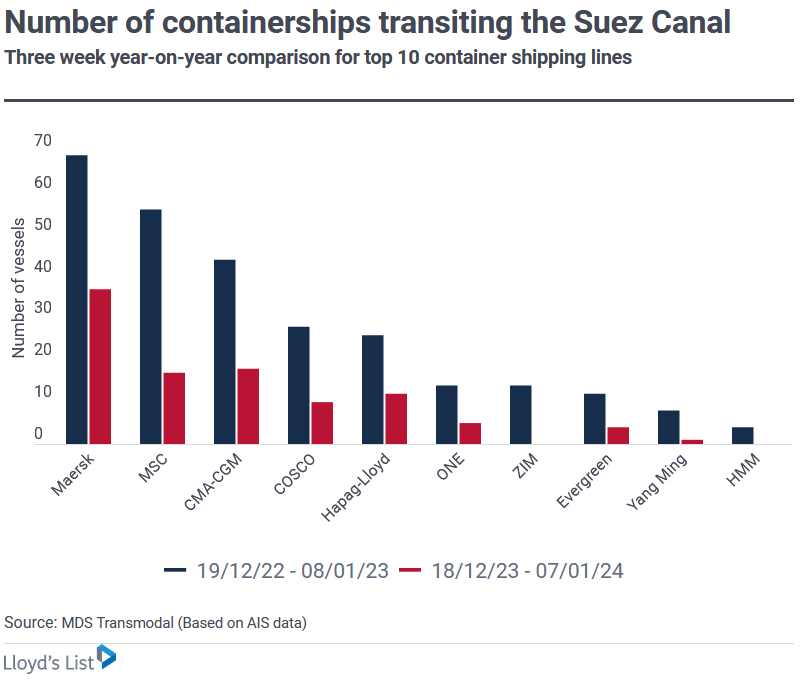

Figures by UK-based analysts MDS Transmodal show that in the three-week period from December 18 to January 7, fleet capacity that moved through the vital east-west artery fell more than 60% on the corresponding period last year from 3.3m teu to just short of 1.3m teu, as carriers increasingly opted for safe passage around the Cape of Good Hope.

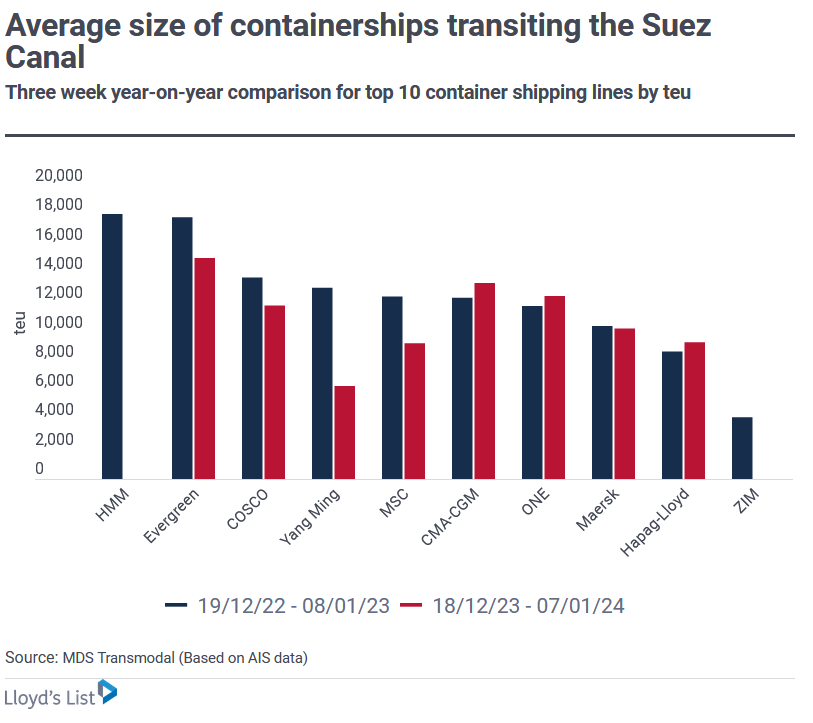

During the period, HMM and Zim were the only carriers among the global top 10 to divert all capacity away from the Suez, while Danish carrier Maersk — having recently announced plans once more to divert all services south of Africa following further attacks on one of its vessels, moved the most capacity through the Suez, according to MDST.

Maersk was the first carrier to resume Red Sea on December 15 after an initial pause. But it reversed the decision following attacks on Maersk Hangzhou (IMO: 9784300), leading to a swathe of diversions. This was despite the US and its allies starting naval escorts in the area.

Maersk’s 37 Suez transits made up just over 380,000 teu across the three-week period, less than half of the journeys reported in the year-earlier period.

French line CMA CGM and fellow European carrier Mediterranean Shipping Company, the world’s largest carrier, were the second- and third-busiest through the Suez across the three weeks respectively. Again, however, overall tonnage making the crossing was down markedly year on year, with capacity moved by CMA CGM falling 56% and MSC down 77%.

Chinese carrier Cosco Shipping — state-owned Cosco Group’s liner arm, has also made a concerted effort to largely avoid the area with just 10 ships sailing through the Suez during the three-week period, compared to the 28 that made the voyage in the year ago period. Earlier this week, Cosco, China’s largest shipping company, reportedly suspended Israel services in the wake of recent attacks.

Maersk Red Sea diversions

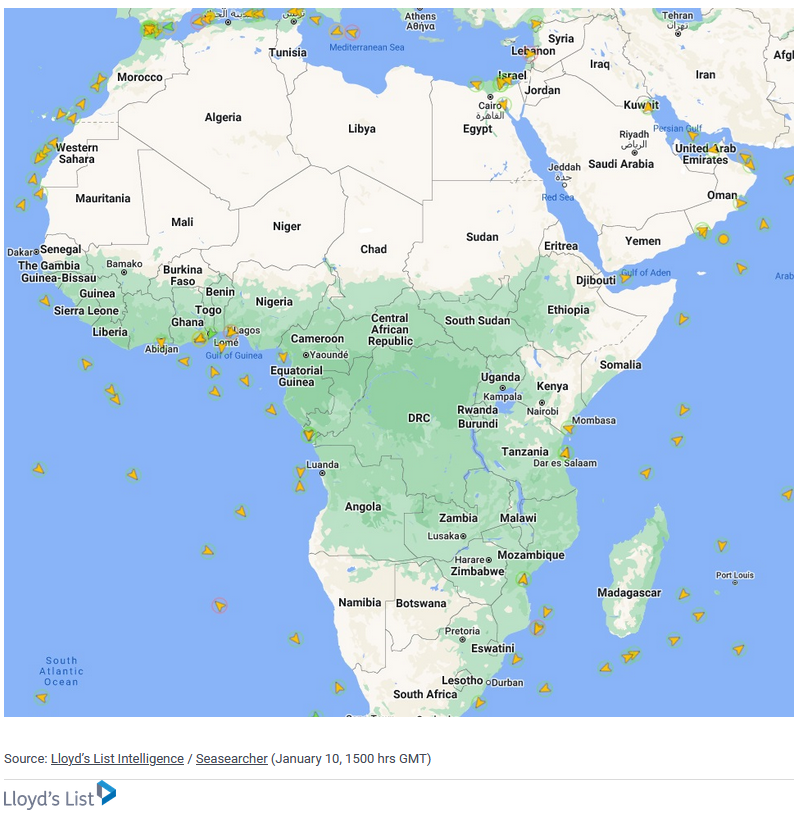

Maersk moved to halt Red Sea transits once more on January 2 following the attack on Maersk Hangzhou. Lloyd's List Intelligence's vessel-tracking data at 1500 hrs GMT on January 10 shows minimal activity by the Danish carrier in the Red Sea region one week later, as vessels divert via the Cape of Good Hope.

Picking up some of the slack has been the smaller carriers, including a fleet of China-owned and operated vessels — as reported by Lloyd’s List earlier this week.

MDST reported that tonnage move outside the top-10 carriers increased across the final two weeks of 2023 and first week of 2024 on last year, rising more than 40% from around 90,000 teu to nearly 130,000 teu.

With only CMA CGM among the larger lines still sending ships via the Suez, and only a handful of smaller carriers following suit, the current rerouting trend is expected to increase in the coming weeks with the Red Sea region still volatile.

Indeed, the latest concentrated attacks on commercial shipping on Tuesday (January 9) were the largest to date.

London-based analysts Drewry said this week that capacity constraints would be short-lived, with a shortage of slot space for shippers likely only up to the Chinese New Year.

Drewry also said that as much as a third of deepsea capacity is currently being affected by the current Red Sea crisis.

MDST senior consultant Antonella Teodoro said that its data suggests a similar total.

She told Lloyd’s List that to address the shortfall in capacity caused by the diversions, MDST estimates as much as 2.6m teu of slot space is required to ensure service frequency.

“This translates to around 200 extra vessels, depending on the ship size deployed and the region served (for example North America would require smaller vessels than Northern Europe),” she explained.

With Chinese New Year approaching on February 10, Teodoro said that carriers might look to split services on core Asia-Europe services.

For example, ahead of China’s factory closures lines could opt to deploy larger ships from China to transhipment hubs in the Mediterranean, such as Tanger Med and Algeciras, before transferring cargoes onto smaller loaders to complete the final leg to other ports across Europe and the wider region.

“Of course, this would operationally be more complicated (both extra time and costs) but would alleviate the pressure on the utilisation of the larger deepsea vessels,” Teodoro said.

Such a strategy has until now only been adopted by Hapag-Lloyd, she added, but Maersk, MSC and others might soon follow suit to address any capacity shortfalls.

However, the extent of such “contingency plans” may put pressure on transhipment hubs and other links in the supply chain.

Congestion at ports was also highlighted in HSBC’s latest Global Freight Monitor Report as a consequence of prolonged rerouting. The issues could soon become widespread due to uncertain vessel schedules and equipment shortages driven by the displacement of empty containers, it said.

The report said the crisis could benefit air and rail operators if carriers stay clear of the Suez, as shippers with more pressing cargoes opt for shorter and more viable route options.

The rerouting to avoid Houthi attacks has sent container spot freight rates through the roof. The latest Shanghai Containerised Freight Index showed gains of nearly 90% on its early December level, with both transpacific and Asia-Europe spot rates more than doubling in recent weeks.

Further rises are expected with carriers informing customers of their intentions to increase freight rates effective later this month.