Capacity cuts help lift Asia-Europe load factors

- By Antonella Teodoro

- •

- 03 Apr, 2019

Blanked sailings and limited supply additions helped liner operators improve their load factor performance on the lucrative east-west trade in the final quarter of 2018, says consultancy MDS Transmodal

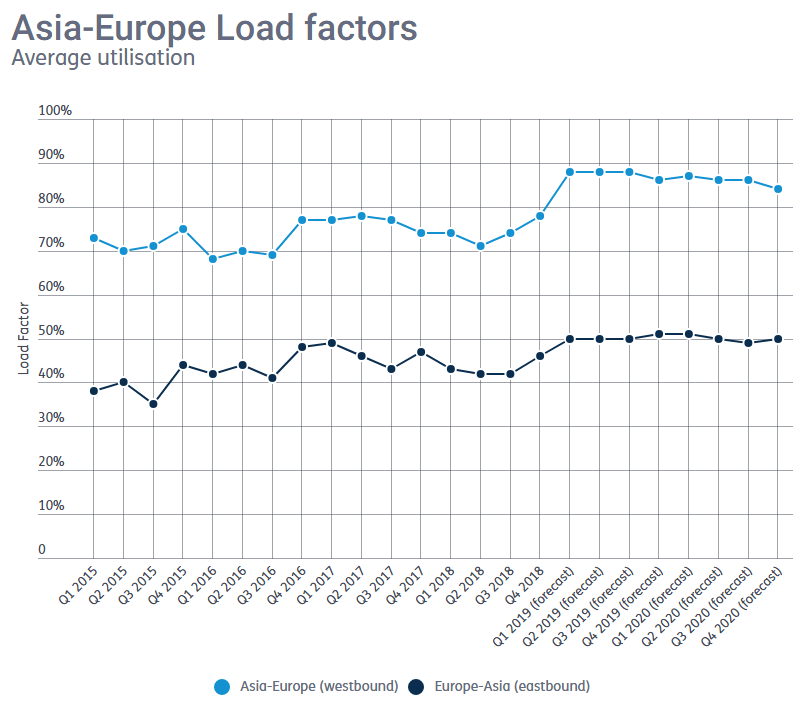

UTILISATION levels on the Asia-Europe improved in the final quarter of 2018, as carriers’ capacity-cutting measures provided dividends.

The last quarter of 2018 saw an increase of approximately two percentage points in the utilisation level on the Asia-Europe trade lane, with demand estimated to have improved by circa 1% and supply estimated to have seen a contraction of 1.5%.

Based on the data available at the time of this analysis, transport consultancy MDS Transmodal projects utilisation to reach a level of 70%, up from a level of 63% estimated for the fourth quarter of 2017.

This increase is due to an expected 10% fall in supply and a 3% uptick in volume demand.

Based on the latest trade data available at the time of this analysis, we estimate that during the fourth quarter of 2018 the principal country pairs on the eastbound direction to have been Russia to China, Germany to China and Turkey to China.

These pairs are estimated to have accounted for more than 25% of the overall traffic moved on this route. Similar shares are expected for the first quarter of 2019.

However, the growth rates estimated for these countries are quite different with Russia to China estimated to have increased by 1%, while Germany to China and Turkey to China are estimated to have seen a contraction of 2% and 11%, respectively.

Looking at the commodities on a Standard International Trade Classification five-digit level and comparing results with the same quarter of 2017, MDST identified ‘Ferrous waste and scrap’, as the main driver behind the increase in trade from Russia to China, climbing 15%.

From Germany to China, the biggest percentage fall at a commodity level was ‘Road parts — other parts and accessories of bodies (including cabs)’, down 9%, while from Turkey to China its was ‘Marble, travertine and other calcareous monumental stone’, down by circa 18%.

Westbound

In the opposite direction, or Asia to Europe, we estimate that the utilisation level has seen an improvement because demand growth outstripped supply, which indeed fell during the three-month period compared with the final quarter of 2017. Demand is estimated to have grown by approximately 4% between the fourth quarter of 2017 and the same quarter of 2018, while supply was down 1% during the same period.

Based on our latest trade data for country pairs, we estimate that the volumes moved from China to Germany and China to the Netherlands generated the highest volume moved on this trade lane, increasing 11% in the fourth quarter of 2018 over the previous year. China to the UK, the third-largest country pair on this route, saw trade fall circa 1%.

On a five-digit SITC level, MDST projects that the main commodity driver on the China-Germany trade was ‘Electric lamps and lighting fittings.’, up by more than 13%.

Meanwhile, ‘Static converters (for example, rectifiers)’, up by circa 15%, were the big movers on a commodity level from China to the Netherlands. And trade between China-UK saw the biggest uptick in the category defined as ‘Tyres, pneumatic, new, of a kind used on motor cars’, up by circa 24%.

Supply side

On the supply side, the Asia-Europe trade lane is experiencing some network reorganisation with shipping lines chasing demand in the Mediterranean market and reducing their presence on the North European routes. 2M Alliance, for example, is moving 11 ultra-large, 19,000 teu vessels from Asia-North Europe to the Asia-Mediterranean trade lane. The major adjustments expected by the 2M Alliance will involve:

• AE11/Jade — An upgrade from 14,000-16,600 teu ships to 18,300-19,400 teu vessels from the end of March;

• AE1/Shogun — The deployment of smaller ships (13,000-14,000 teu); however, the number of ships offered on this service will increase from 11 to 16 to allow for a more efficient use of fuel and reliability;

• Both AE1/Shogun and AE6/Lion services will be extended to the transpacific route. This will mean that the 2M Alliance will now operate three Europe — Asia — North America West Coast pendulum services in addition to its PHX/JAG/AE12/TP2 service.

By contrast to the 2M Alliance’s strategy, Ocean Alliance has announced the introduction of an extra loop to its Asia-North Europe network from April. This extra loop does not come as a surprise given the new ultra large containerships on course to be delivered to the Ocean Alliance’s members. As much as 45% of the ULCs due for delivery this year will be delivered to the consortia.

The Alliance’s members are also expected to increase the number and size of vessels in their fleet on the Asia-Mediterranean trade lane from April. Ten 8,100-10,000 teu ships deployed on its Asia-Mediterranean MD1 loop will be replaced with 11 13,500-14,220 teu vessels.

Asia-Europe capacity changes

(Fourth quarter of 2018)

Supply additions

• 2M Alliance (SWAN/AE2) — Temporary suspended, but re-started just before the start of the New Year

• Ocean Alliance (FAL6/LL6/CEM) — Capacity increased 23% with the introduction of 20,000 teu newbuilds operated by Evergreen

• The Alliance (FE5) — Deployed capacity increased by 25%

• The Alliance (MD1) — Slot space increased by 16% with the addition of larger vessels

Capacity cuts

• Cosco/Evergreen/OOCL (FEM/EM2) — Capacity reduced 10%

• Ocean Alliance (FAL7/LL3/NE7/AEU7) — Alliance has pulled 10% capacity quarter-on-quarter