Changing lanes: Carriers’ regional strategies

The easing of global lockdowns has prompted lines to resurrect a number of blank sailings, with more services expected to be brought back online in the months ahead

While capacity has been withdrawn significantly on the major east-west trades, carriers have moved to up their offering on regional trades and most notably intra-Asia

THE MAJORITY OF THE TOP 20 CONTAINER PORTS ARE EXPECTED TO EXPERIENCE HIGHER YEAR-ON-YEAR GROWTH IN THE THIRD QUARTER OF 2020

AT THE beginning of April there were 1m confirmed coronavirus cases worldwide. Lockdowns were enforced in many countries.

Four months later, with the number of global confirmed cases exceeding 18m and new daily infection rates among the highest since the start of the pandemic, lockdowns have eased.

The world will not be coronavirus free until a safe and effective vaccine is available to everyone. However, the pressure to return to some sort of normality is mounting, albeit with necessary precautions in place.

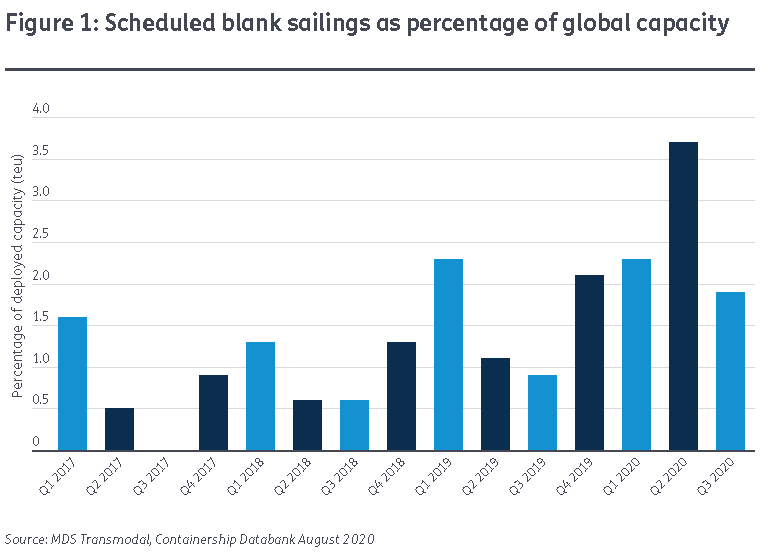

A confirmation of life returning to some normality has been provided by moves by shipping lines to significantly decrease the number of blank sailings anticipated in the months ahead.

Figure 1 shows the blank sailings as a percentage of the total scheduled deployed capacity in the last 15 quarters.

With more than 28m estimated loaded teu and a share of about 18% of the global maritime containerised trade estimated for 2019 (up from the 16.5% estimated the previous year), the intra-Asian region is attracting the most attention from shipping lines.

Geneva-based carrier Mediterranean Shipping Co is among the latest to announce plans to increase its service offering in this area.

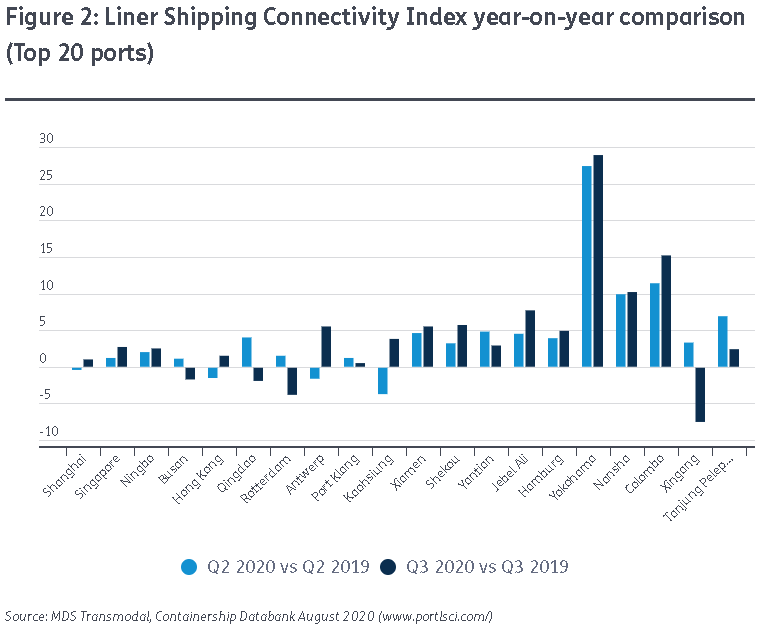

Signs of improvement are also emerging on MDS Transmodal’s Liner Shipping Connectivity Index.

The majority of the top 20 container ports are expected to experience higher year-on-year growth in the third quarter of 2020, as shown in Figure 2.

The improvements in the LSCI, which is produced in collaboration with UNCTAD, are mainly driven by an increase in ship size, leading to a rise in the deployed capacity on offer.

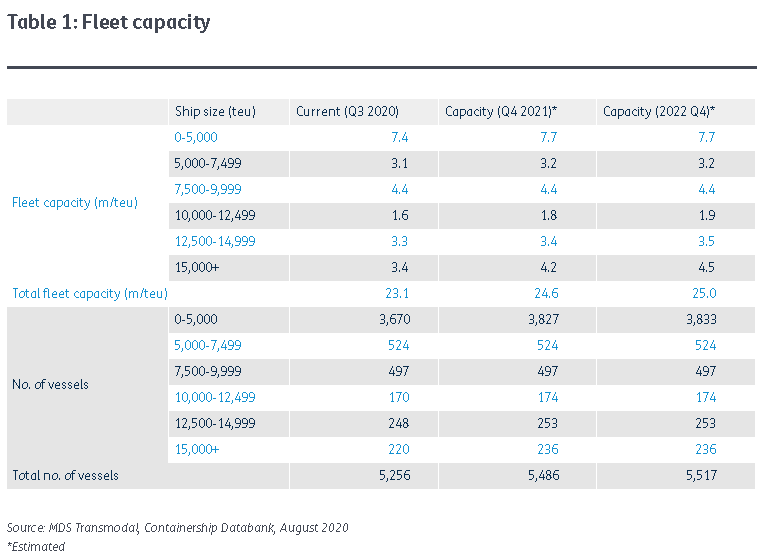

Looking at the near future and at the ships on order, lines seem to be confirming a willingness to return more capacity to the container shipping market.

The most up-to-date data shows estimates for an increase of more than 6% of total fleet capacity (teu) by the end of next year and a further increase of about 2% the following year (see Table 1).

We also expect the percentage of ships with a capacity of 15,000 teu or more to increase the most (21.8% by 2021).

First published on Lloyd's List website August 2020