Changing lanes: New entrants do little to level boxship playing field

- By Antonella Teodoro

- •

- 21 Jun, 2022

New operators are estimated to account for 5% of the total capacity scheduled to be deployed in regions where they are active

THE increase in spot and contract freight rates, accompanied by a deterioration in liner service quality, has garnered plenty of column inches in the trade and financial press. With good reason.

Freight rates have not returned to 2019 levels and the quality of services is far from perfect.

However, from an analyst’s perspective various other interesting topics are emerging, one of which is new trade entrants: how many additional liner shipping companies are involved in the industry? And how much do they account for in terms of scheduled capacity deployment? Further, how have consortia combined market shares changed in the last few years? We aim to provide some insight into these topics.

New entrants

Based on the most up-to-date dataset available at the time of this analysis and focusing on the services scheduled on the deepsea routes (ie, excluding intra-regional services) between Q1 2019-Q2 2022, MDS Transmodal counts 15 new entrants active in Q2 2022, with Q3 2020 the first quarter in which we see new trade entrants.

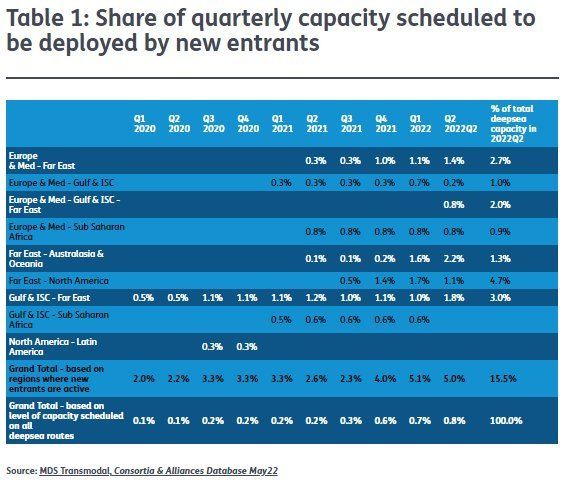

New operators are estimated to account for 5% of the total capacity scheduled to be deployed in regions where they are active and for 0.8% of the overall total deepsea global capacity. Unsurprisingly, the trade lanes primarily attracting new entrants are the Transpacific and Far East–Europe/Mediterranean trades, as shown in the first table below.

The percentage of capacity deployed by the new entrants has been increasing over the last few quarters; however, these levels are still modest and their effect on the level of competition in the shipping industry can be regarded as negligible.

Consortia combined market shares*

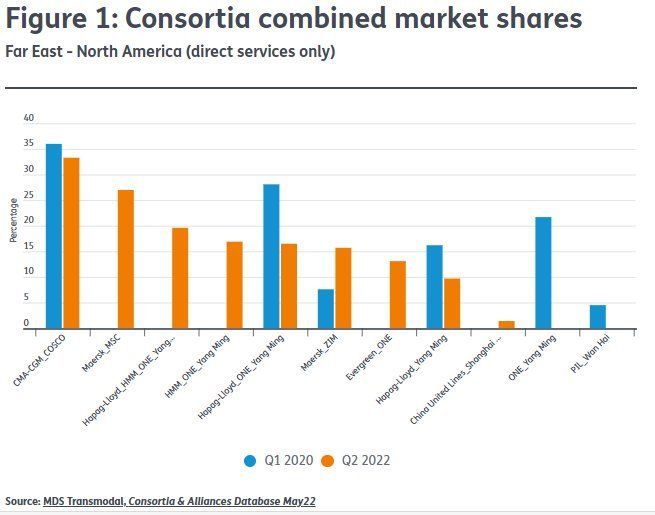

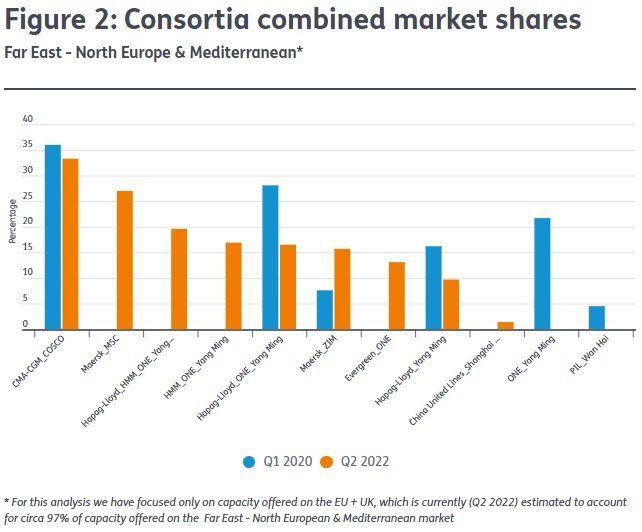

Analysing the combined market shares of the consortia active on the two major trade lanes, Transpacific and Far East-Europe/Mediterranean trades, MDST observes that these shares have remained high since 2020. But some interesting developments have occurred during this period.

On the Far East-North America direct trade lane, the combined market share for CMA CGM & COSCO in the second quarter of 2022 has declined by three percentage points against the first quarter of 2020. However, this remains above 30%.

The combined market share estimated for Hapag-Lloyd-ONE-Yang Ming has also fallen since the first quarter of last year. Yet this appears to be due to changes in the composition of the consortia among the The Alliance members, with HMM joining the carrier group in early 2020.

The most interesting change for this trade lane is undoubtedly offered by Maersk and fellow European carrier Mediterranean Shipping Co. In the first quarter of 2020, the pair did not (together) offer any direct services between the Far East and North America.

Fast forward to the second quarter of 2022 it is estimated that the capacity they offer on direct services account for more than 66% of the overall capacity offered on the transpacific trade. Their combined market share on the Far East-North America direct trade lane is estimated to equate to some 27%.

The limited number of significant players and the limited number of markets where they can operate might induce an assumption that they would have established their positions in specific corridors. MDST’s analysis on the combined market shares suggests that this is not necessarily the case.

Facilitated by the formation of consortia, among members of the same alliance or not, carriers within a relative short period of time can expand their presence on different routes. From a competition point of view, this could be regarded as ‘healthy’ behaviour.

This may well be the case. However, the implications that could derive from such movements are without doubt among the key aspects to regularly watch in the container shipping industry and not necessary exclusively at times of crises.

* In this article, ‘combined market share’ refers to the definition in European Union legislation for the Consortia Block Exemption Regulation, so, for any given consortium, the combined market share is the sum of the market shares of its individual members