Changing Lanes: UK’s growing reliance on shortsea shipments to fulfil deepsea duties

- By Antonella Teodoro

- •

- 07 Jul, 2021

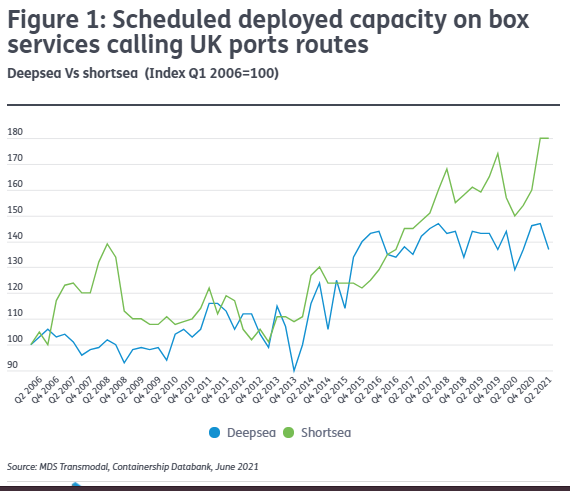

Shortsea capacity on routes in and out of the UK continues to climb at a faster rate than on deepsea services, reaching record levels in the first quarter of 2021

UK ports remain less connected to the deepsea than to the shortsea market, despite non-European containerised trade representing the majority of cargo to and from the country, according to MDS Transmodal data.

During the first quarter of 2021, overall scheduled capacity deployed on container services calling at UK ports equated to an annualised level of more than 28m teu. This is the highest level yet reported in our Containership Databank dating back to the start of 2006, which has grown 54% over this period at a CAGR of 2.9%.

However, while the capacity deployed on the deepsea routes (i.e. intercontinental services) has been growing at a CAGR of 2.6%, the capacity deployed on the shortsea routes (i.e. services within the North Europe & Mediterranean) has increased by a CAGR of 4%.

Capacity deployed on the shortsea routes, as shown in Figure 1 below, has experienced uninterrupted faster growth than that on the deepsea services since 2016, with data for recent quarters suggesting a growing gap between the two markets.

While capacity on deepsea routes was substantially flat compared to the previous quarter, capacity deployed on the shortsea routes was up by approximately 20 percentage points over the same period, reaching a new high of 180 points on MDST’s Containership Databank.

Comparing the level of capacity on the container services offered between the UK and the European/Mediterranean market in the first quarter of 2021 to the corresponding three-month period of 2016, MDST estimates that overall capacity has increased by around 38%.

The share of capacity deployed by the alliances or their members has increased from 53% to 68% during this five-year period, while capacity offered by their subsidiaries has risen from 18% to 20%.

Extending the analysis to the wider intra-European & Mediterranean market, MDST estimates that the share of capacity offered by subsidiary companies (with the holding company part of an alliance) has increased from 9% to 14% during this same timeframe.

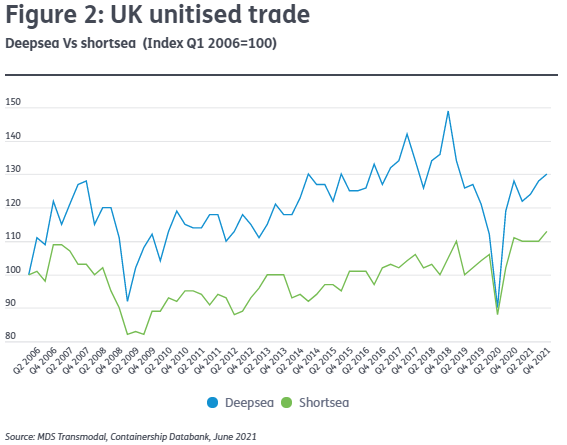

On the demand side, however, cargo moved between the UK and the deepsea market has continued to grow at a faster rate than cargo within the intra-European market, as shown in Figure 2.

Assessing the supply and demand trends, it would appear that UK cargo to and from the deepsea markets is increasingly moved on shortsea box services with direct calls between the UK ports and non-European markets increasingly declining.

It is difficult to name one specific factor behind this development as various events have been (and still are) affecting UK trade flows and the global supply chain more in general.

Above others, in the case of the latest trends experienced by UK, they can partly be seen as a reaction to Brexit (to avoid too great an emphasis on the Short Straits) and partly as a response to the increasing costs in central and eastern European road haulage, as drivers’ wages are increasing.

However, considering the longer-term trends, with shipping lines increasing the level of their co-operation through mergers and acquisitions, in addition to the formation of new alliances, it can be assumed that container services within the European market have become increasingly competitive and have gained share at the expense of ro-ro services.