Covid-19 – What Happened to UK Airfreight?

The Covid-19 pandemic introduced a significant change to operating practices in the UK air freight market. However, this necessary change was temporary and driven by the practical realities of the pandemic. A degree of normality appears to have returned, albeit within a slightly smaller market overall.

On 5 May 2023, the World Health Organisation (WHO)

officially declared that Covid-19 is no longer considered a global health emergency. While all freight transport sectors were

impacted by the global pandemic commercially and had to adjust their operating

practices, the air freight sector was arguably the most impacted.

The airfreight market is divided into two broad segments. Firstly, goods flown in the bellyholds of aircraft operating passenger services. Bellyhold airfreight generally moves on long-haul inter-continental trade routes, such as between the Far East and Europe or North America, where wide-bodied aircraft are deployed. Narrow-bodied aircraft used on shorter intra-continental routes have far less space and have fast turnarounds at airports.

The second market segment is cargo moved in dedicated ‘freighter’ aircraft (i.e. configured to convey cargo only). This itself is further divided into services operated by the express logistics providers such as DHL or Fed-Ex (also known as integrators ) which generally move individual consignments at less than pallet-load, and larger volumes flown on scheduled freight-only services or chartered aircraft (e.g. project cargo).

Prior to Covid-19, bellyhold was the dominant segment in the UK airfreight market. In 2019, the total volume of cargo lifted at airports was 2.5 million tonnes, of which 1.8 million tonnes (70%) was flown in the bellyholds of passenger services. Heathrow airport accounted for 85% of bellyhold tonnage. The remaining cargo volumes conveyed in freighter aircraft were predominantly handled by the integrators, mainly via Stansted and East Midlands airports. The bellyhold segment’s dominance had grown over the previous decade, having increased from 66% of UK airfreight volumes in 2009. A number of factors explained this position:

i.Heathrow is a major ‘hub’ airport for passenger services, with an extensive route network of daily direct long-haul flights using wide-bodied aircraft to a multitude of key destinations; and

ii.Bellyhold capacity is effectively sold at marginal cost i.e. the passengers cover most of the fixed and variable costs of the flight.

In contrast, dedicated freighter aircraft need to cover all their operating costs from the cargo lifted. As a result, they are only economic when operating at near 100% load-factor levels in both directions, and there are very few trade-routes to/from the UK which generate such volumes on a daily basis. Bellyhold allows for frequent (daily) shipments to be made at more competitive rates between a much wider range of destinations.

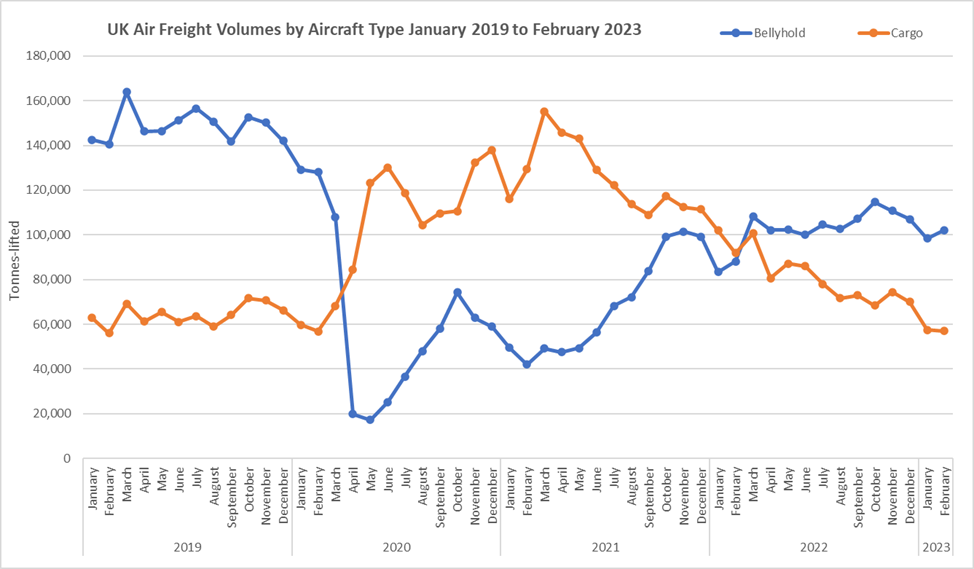

The chart below, showing cargo volumes by aircraft type at UK airports from the start of 2019 to February 2023, illustrates how the industry responded to the Covid-19 pandemic (source: CAA).

During the pandemic many long-haul passenger services were suspended/withdrawn, due to a combination of low passenger demand and travel restrictions imposed by Governments. A significant level of bellyhold capacity was therefore removed from the market. As a result, the volume of bellyhold freight collapsed between February and April 2020; it fell from circa 130,000 tonnes-lifted in January 2020 to 20,000 tonnes-lifted in April 2020.

However, shippers still needed to transport their goods by air, including the delivery of essential medical supplies to deal with the pandemic. Out of necessity, therefore, goods hitherto flown in bellyholds were switched to freighter aircraft, with the volume of cargo shipped in this manner increasing from just under 60,000 tonnes in March 2020 to a peak of circa 160,000 tonnes a year later. Some of these freighter aircraft were passenger planes temporarily re-purposed to convey air freight, including so called ‘preighter’ aircraft where cargo is flown in the main cabin alongside a small number of passengers, albeit they are classed as cargo aircraft in the CAA statistics.

Bellyhold freight partially recovered up to late Autumn 2020 as some passenger capacity was restored (at the expense of cargo-only aircraft), albeit volumes again declined through winter 2020/2021 during the second-wave of the pandemic, when further travel restrictions were imposed and passenger capacity was again reduced. This decline was reflected by an increase in the volume of cargo moved on freighter aircraft. As an aside, many of the freighter aircraft flights used Heathrow airport, driven by available space at the existing land-side logistics infrastructure (e.g. BA World Cargo Centre) but also taking advantage of the runway slots vacated by passenger services.

Since Spring 2021, travel restrictions have been progressively lifted following Covid vaccination programmes. Passenger demand has been increasing, and the long-haul passenger sector has slowly recovered and reintroduced services. The level of available bellyhold capacity has risen as a consequence, and this is reflected in the gradual increase in the volume of cargo moved in that manner since March 2021. Correspondingly, the volume of cargo moved on freighter aircraft has declined gradually since then, and a degree of normality was restored in March 2022 as bellyhold freight once again become the largest market segment.

It would therefore appear that the Covid-19 pandemic introduced a significant change to operating practices in the UK air freight market. However, this necessary change was temporary and driven by the practical realities of the pandemic. As the passenger sector has recovered, shippers (via forwarders) have been returning to their pre-Covid commercial arrangements, for the reasons presented above. The gap between the bellyhold and freighter segments has been growing since March 2022.

However, the total air freight market in 2022 was 13% lower (when measured in tonnes-lifted) compared with 2019 volumes (2.2 million tonnes-lifted in 2022), and 16% lower than the peak in 2017 (2.6 million tonnes-lifted). Reasons for decline are likely to include:

·Low economic growth in the UK following Brexit and the pandemic, meaning reduced demand for the higher-value goods moved via airfreight; and

·Less transhipment between long-haul services – around 15% of Heathrow’s airfreight volumes pre-Covid effectively never left the airport and simply moved between connecting flights. Growing airfreight volumes in other EU countries since 2019 suggests that some of this trade may have been captured at competing airports in mainland Europe.

Operating practices have returned to something approaching normality, albeit within a slightly smaller market overall.