From decline to recovery: UK agri-food exports to the EU show growth in 2025

Nour Farid • July 23, 2025

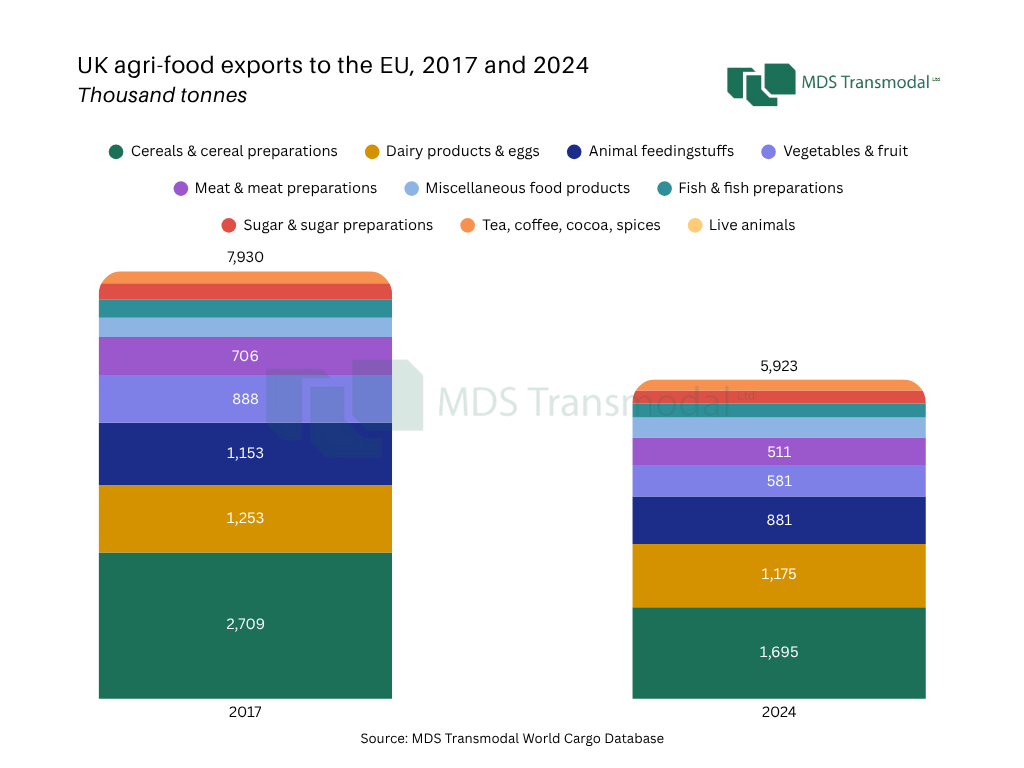

Data comparing UK food and agricultural exports in 2017 and 2024 highlights a significant shift in trade dynamics between the European Union (EU) and non-EU markets, reflecting the impact of Brexit on the UK’s trade relationships. More recently, however, year-on-year figures suggest that a recovery in EU exports may be taking shape. This raises questions about the future of the UK’s agricultural and food sectors, and more broadly, its economic ties with Europe.

The chart above shows the notable decline in UK agri-food exports to the EU, which dropped from over 7.9 million tonnes in 2017 to around 5.9 million tonnes in 2024, a reduction of over 25%. This decrease spans nearly all commodities:

- Cereals and cereal preparations (-37%), along with vegetables and fruit (-35%), which previously represented substantial volumes, saw marked reductions.

- Dairy products & eggs (-6%) and meat & meat preparations (-28%) —sensitive sectors post-Brexit—also experienced noticeable declines. These drops may reflect increased sanitary and phytosanitary (SPS) checks and customs requirements post-Brexit.

- Only minimal changes are seen in less significant categories in terms of volume such as tea, coffee, cocoa, spices.

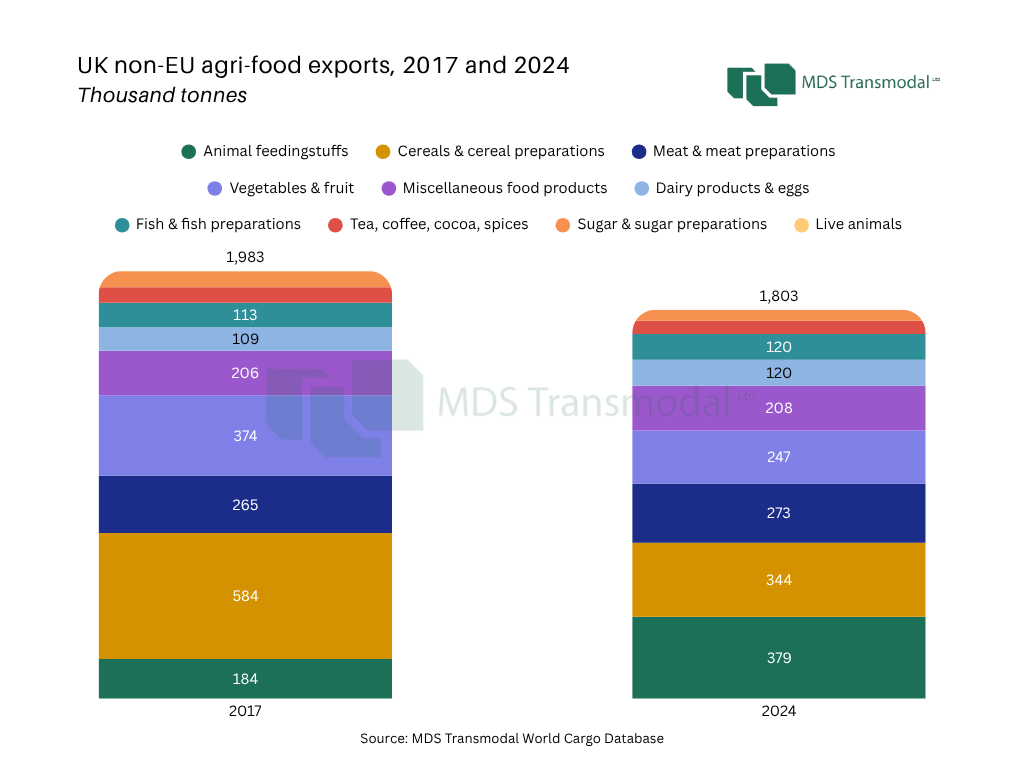

This chart provides context by comparing UK agri-food exports to non-EU countries from 2017 to 2024. Unlike the EU trend, non-EU exports (from a much lower base) declined only slightly, from 1.9 to 1.8 million tonnes—a drop of 9%.

Key trends include:

Key trends include:

- Animal feedstuffs doubled from 184to 379 thousand tonnes

- Dairy, fish, and meat exports saw modest growth

- Cereals and vegetables & fruit declined by similar percentages to the EU market

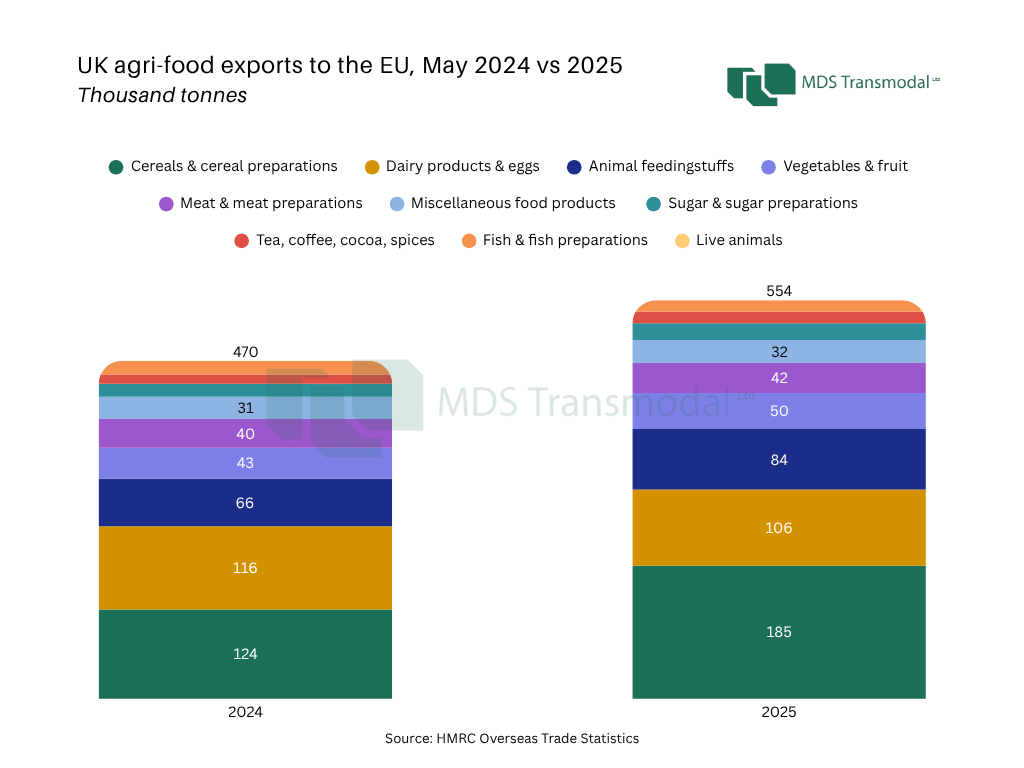

Monthly data comparing May 2024 to May 2025 reveals a potential turnaround. In just 12 months, total exports to the EU jumped across nearly all categories:

- Cereals & cereal preparations saw the most significant year-on-year increase of 50%

- Animal feedingstuffs also rose considerably by 27%

- Meat, vegetables & fruits, tea, coffee, cocoa, and spices experienced moderate gains, signalling a broader trend rather than a commodity-specific shift

This improvement may indicate that UK exporters are adapting more effectively to the post-Brexit trading environment. A renegotiated EU relationship, which would remove the need for SPS checks, might yield an even greater improvement in trade with the EU.