Is there still competition in liner shipping?

MDS Transmodal has developed a database providing more certainty on consortia on trade corridors to and from Europe, and which exceed the threshold of the EU’s Consortia Block Exemption Regulation

There is much less competition in liner shipping than commonly assumed, due to a proliferation of vessel sharing agreements or consortia which provide carriers with the knowledge and capabilities to adjust ship capacity rapidly in line with changing demand

MDS TRANSMODAL’S DATABASE SHOWS CONSORTIA OPERATING ABOVE THE CBER THRESHOLD ON MEDITERRANEAN AND NORTH EUROPEAN TRADES.

THE state of competition in liner shipping is easily misunderstood. The traditional monitoring tools of competition regulators, such as market shares of ship operators or variations of such measures, only tell part of the story.

The reason is that the real market power is hidden behind a well-developed system of consortia. These are co-operation agreements between carriers to share vessels. Global alliances can be considered bundles of consortia and are also considered in this analysis.

There is a huge number of consortia: the major container carriers were active in hundreds of consortia covering 194 different trade corridors worldwide in the third quarter of 2020.

This becomes clear from analysis of a unique dataset by MDS Transmodal that contains deployed ship capacity of container carriers on all of their liner services.

This dataset has been developed using the MDST Containership Database also used by the UN Conference on Trade and Development for the Liner Shipping Connectivity Index (LSCI) and by the World Bank for the Logistics Performance Index (LPI).

Thanks to this database, it is now possible to provide more certainty on consortia on trade corridors to and from Europe. This is relevant for several reasons.

First, whereas the Federal Maritime Commission requires carriers to file their consortia that touch the US market, the European Union Directorate-General for Competition does not have information on how many consortia exist within the EU market and on trade lanes to and from Europe.

With this new database, we will now be able to establish how many consortia touch European ports, and monitor how this will change over the next years.

This is all the more relevant, since the EU has a special regulation, the Consortia Block Exemption Regulation (CBER), which gives liner companies more freedom to co-operate than generic EU competition law allows.

According to that regulation, carriers can use consortia to jointly adjust their ship capacity and exchange data with other carriers on a variety of issues. This is not without risks.

Carriers could use consortia to engage in profit maximisation via joint capacity management. The new database can be linked to other databases, including on trade data, services performance and connectivity, which allows the assessment of the impact of an increased level of concentration.

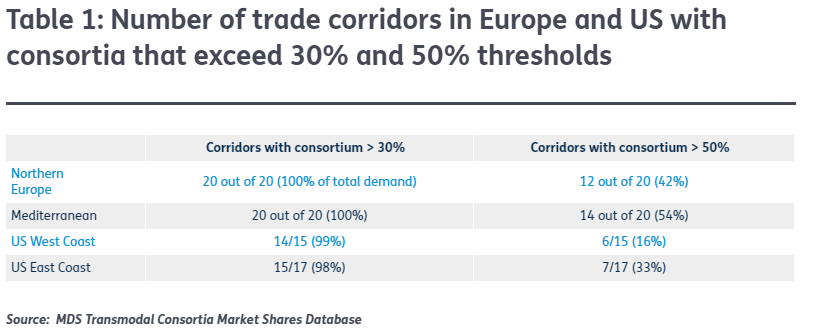

Finally, it should be noted that the EU’s Consortia Block Exemption Regulation only applies to consortia that do not exceed a threshold of 30% market share, calculated as the sum of market shares on a trade lane of the operators that co-operate in a consortium.

A report by the International Transport Forum in 2019 indicated that most of the consortia on trades to and from Europe were likely to exceed the threshold, but that this was not possible to know with full certainty considering the way the regulation is formulated and the lack of data collection on consortia.

The report advised the European Commission — among other things — to clarify its provision on the threshold and to initiate data collection on consortia and their effects. In 2020, the commission instead extended the Consortia Block Exemption Regulation to 2024, without any changes or conditions.

The new database will be able to clarify which consortia are still covered by the CBER and which ones exceed the threshold, and are thus no longer covered.

A first look at the data reveals high levels of concentration. Out of the 20 trade corridors identified to and from Northern Europe, all corridors were operated by one or more consortia with market shares higher than 30%. This was the same for the Mediterranean.

Even more dramatic was how 14 out of the 20 trade corridors to and from the Mediterranean (representing 54% of total estimated loaded teus) had consortia with market shares larger than 50%.

On some trade corridors the market share of a consortia actually exceeds 80%.

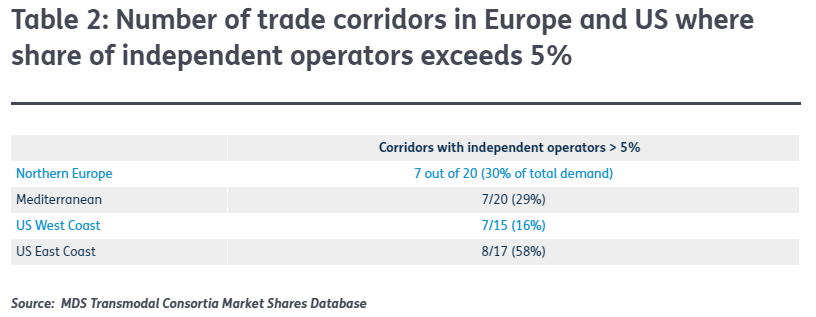

The share of independent operators, not co-operating in consortia (and not operating within an alliance), has become marginal. They have market shares of at least 5% in 7 out of 20 corridors to and from Northern Europe (30% of total demand), which means that they have a market share below 5% on the 13 corridors representing 70% of demand.

In comparison, liner shipping to and from both the US west coast and US east coast appears to be more competitive, with considerably fewer consortia with market shares larger than 50% (see Table 1).

Moreover, the US east coast has a larger share of independent operators than is the case in Northern Europe, Mediterranean and the US west coast.

In addition, it should be noted that all the major carriers cooperate with each other via sets of overlapping consortia that are supposed to compete with each other.

Fair enough, consortia compete with other consortia on most trade corridors, but members of competing consortia on one corridor (eg North Asia-Mediterranean) cooperate in other consortia on other corridors that might be related (say intra-Mediterranean).

In Europe alone, the top nine carriers are involved in hundreds of different consortia, in addition to their co-operation in three global alliances. The interlinked consortia are the institutional expression of the close commercial ties between carriers, where interests are getting synchronised rather than competitive.

This web of consortia provides carriers with the knowledge and capabilities to adjust ship capacity rapidly in line with changing demand — and to an extent that they manage to improve profitability in the process, as seen during the coronavirus crisis.

Competition authorities should do well to not only look at market shares of individual operators, or alliances, but also to take the emerging reality of interlinked consortia into account. The data is now available.

Olaf Merk is ports and shipping administrator at the International Transport Forum.

MDS Transmodal Consortia Market Shares Database developed by Antonella Teodoro.

First published on Lloyd's List website January 2021