More container service cancellations likely

- By Antonella Teodoro

- •

- 09 Apr, 2020

Another wave of cuts in deployed capacity and further reduced frequency of maritime container services is expected in the coming weeks due to the coronavirus, resulting in about 27% of supply being removed from the Asia-Europe trade alone. But with shops selling non-food items pulling down the shutters across Europe, warehouses are full and shippers with goods in transit will likely be faced with surplus stock

The health crisis has also led to the delayed launch of several new deepsea services

THE reduction in container shipping capacity was originally caused by the closure of Chinese factories in the wake of the country’s coronavirus lockdown which, in turn, caused the slowdown in Chinese port activity.

Port operations in China are now returning to normal as factories are gradually reopening. However, given that nearly all European countries are implementing full or partial lockdown measures to limit the spread of coronavirus, further disruption of maritime services can be expected.

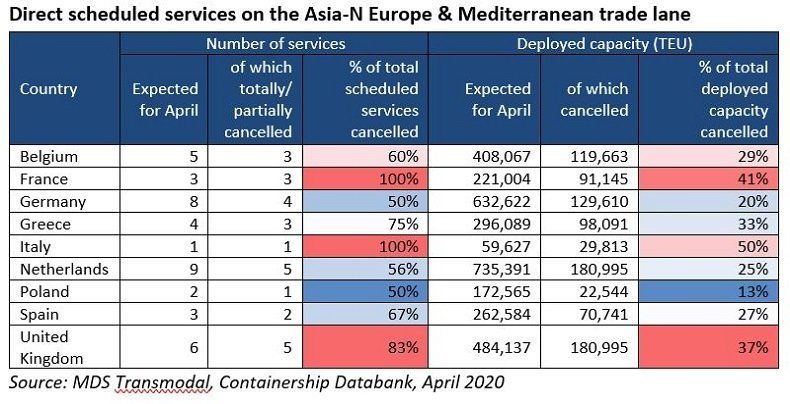

Based on our data available at the beginning of April, we estimate that there could be a cut of more than 27% in the capacity deployed on the direct services offered on the Asia-Europe trade lane and a reduction of circa 4% of the direct services offered on the transpacific trade lane during the month.

The health crisis is also behind the decision to delay the launch of new deepsea services.

The East Mediterranean – America service, known as EMA, offered by the carriers Cosco, ONE, OOCL and Yang Ming between the eastern Mediterranean and the US east coast (New York, Norfolk and Savannah), was expected to start operating at the beginning of April. It is now postponed to the end of the month.

The service is scheduled to deploy six ships with an average capacity of 4,500 teu.

The 2M Alliance has also confirmed a significant reduction in the DRAGON/AE20 and SWAN/AE2 services throughout the second quarter of the year. These are now only expected to be fully operational in June.

Together, these two services were expected to offer approximately 162,000 teu on the Asia-Europe trade and circa 10% of the capacity on offer on the Asia-Gulf-Europe trade lane.

Similar measures have been put in place so far and are expected to be retained by the other consortia — The Alliance and Ocean Alliance — in order to prevent containers being left in ports full of goods that are no longer required by the increasing number of shops closed worldwide; and shippers invoking force majeure clauses within their contracts.

On March 8, The Alliance announced the consolidation of the FE2 and FE4 services on the Asia-Northern Europe trade lane for seven weeks for May and June, while also cancelling sailings on the Asia-Mediterranean trade lane.

With shops selling non-food items shutting as a result of lockdowns around Europe, warehouses are full and therefore shippers have goods in transit with nowhere to store them. Some shippers have cancelled orders from global suppliers, with a knock-on effect on shipping lines’ traffic.

In order to limit the contract cancellations, Mediterranean Shipping Co is offering a suspension of transit service to their customers exporting from China, allowing them to get their cargo closer to the final destinations.

This service, offering to store containers at various transhipment hubs across Asia, the Middle East, Europe and Americas, is also designed to limit the negative impacts on supply chains once the impact of the coronavirus pandemic eases.

Another way of managing capacity in this extraordinary time is proposed by CMA CGM, which is expected to deploy some of its vessels on the Asia-Europe trade lane via the Cape of Good Hope avoiding the Suez Canal.

This adds approximately 7,500 miles to the traditional routing, or an increase in the round-trip timing by about 13%.

If all Asia-North Europe services were to be modified in the same way, then not only would lines make a net saving in canal tolls against bunker costs (currently very low) but the same fleet (effectively representing a fixed cost) would provide a reduced capacity.

The impact on stevedoring companies with en route terminals could be significant if Asian services to Northern Europe were thereby entirely separated from those to the Mediterranean.