Changing lanes: China retains ‘factory of the world’ crown amid pandemic

- By Antonella Teodoro

- •

- 03 Mar, 2021

China’s share of global containerised trade increased to 34% in the final quarter of last year, according to MDS Transmodal figures

China’s exports are on track to return to pre-pandemic levels despite the initial shock of the coronavirus last year. The country has led the container industry’s recovery, while increasing its market share of global box trade in the process

WHEN Chinese factories shut down in early 2020 it sent shock waves across supply chains, making businesses and governments reassess their reliance on China as the world’s manufacturing powerhouse.

However, after Chinese exports (measured in teu) slumped by around 11% in the first two quarters of 2020, the country is now well on track to return to pre-pandemic levels.

In the third and fourth quarters of last year, its exports experienced an annual increase of about 3.5% and approximately 14%, respectively, resulting in a year-on-year drop of just 1%, which is less than the overall global fall in containerised trade estimated to be in the region of 1.6%.

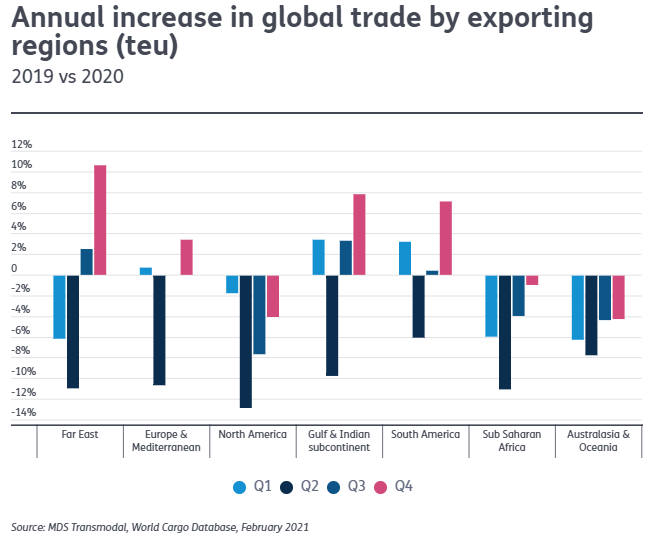

China’s strong results meant that the Far East exhibited the most significant increase in the fourth quarter of 2020 for containerised exports of all world regions, estimated to be up almost 11% compared with the previous year.

Yet, as shown in Figure 1, the Far East has not been the only world region to show signs of recovery in its exports.

The Middle East Gulf and the Indian Subcontinent, South America, and Europe and the Mediterranean regions all saw an increased in exports during the final three months of 2020, albeit of a lower magnitude.

From electricals to bicycles: how Covid-19 has influenced

consumer choices

With consumers’ confined to their homes for much of 2020

amid coronavirus lockdown procedures, it comes as little surprise to see that

increase experienced by the increase in Chinese exports in the final quarter of

2020 was driven largely by gym equipment which more than doubled.

Bicycle/motorbike exports also increased by around 200%,

while kitchen appliances and (home) office electronic machines and equipment

increased approximately 50%.

If China has been delivering machines and equipment to an increased number of people working/studying and needing entertainment while at home, Brazil has been delivering tea and coffee to the world.

In the fourth quarter of 2020, MDST estimates an annual increase of more than 23% compared with 2019 for this commodity group, an increase that has been accompanied by an improvement in Brazil’s position in the global league of exporters for this commodity, up from 9% to 11%.

As for the European and Mediterranean countries, the increase in exports in the final quarter of the year was largely down to cereals/cereal preparations, increasing 9% on the final three-month total for the previous year.

The increase, however, was not enough to help Europe close the gap on the US as the dominant global exporter this commodity having increased its market share of cereal/cereal preparations to more than 13% compared with 9% in the final quarter of 2019.

Agricultural products and food products in general were among the goods to have experienced the fastest growth in the latter stages of 2020 and were the least impacted commodity group during the pandemic.

On the other hand, it was vehicles and vehicle parts that saw the sharpest contractions last year, with Japan among the most affected of exporting countries.

The different way in which the pandemic has impacted the different economic sectors around the world has offered the opportunity for some countries to improve the level of their international competitiveness or, by contrast, a deterioration in their market share.

But it was China that managed to improve its dominant global position.

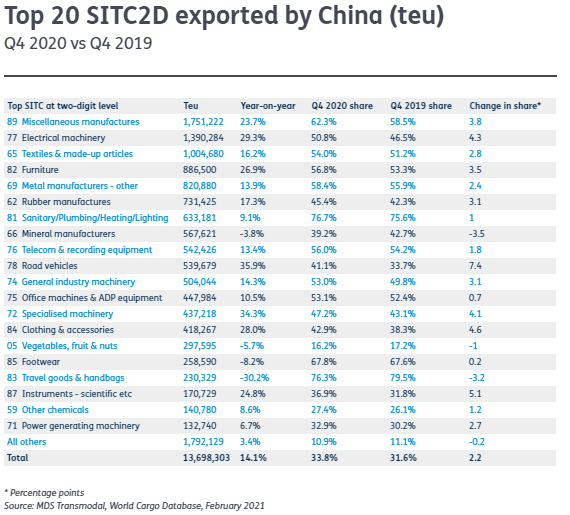

The table below shows how it increased its global share of containerised exports in most of its top 20 Standard International Trade Classification (SITC) two-digit commodity groupings in the last quarter of 2020.

With an overall share of 34% of the global trade in the fourth quarter of 2020, up from 32% in the same quarter in 2019, China is showing it has the resilience and determination to remain the “factory of the world”.