Changing lanes: Growing independence as alliances evolve

- By Antonella Teodoro

- •

- 04 May, 2023

MDS Transmodal analyses the latest patterns and trends shaping the container shipping market

While key box carriers have continued to enhance their respective fleets, there is an increasing tendency to go it alone and operate networks more independently rather than boost alliance co-operation

IN March 2020, the European Commission extended, without modification, the Consortia Block Exemption Regulation to April 2024. Ahead of the renewal, MDS Transmodal looks at how much capacity is offered by consortia now compared with 2019 on deepsea services.

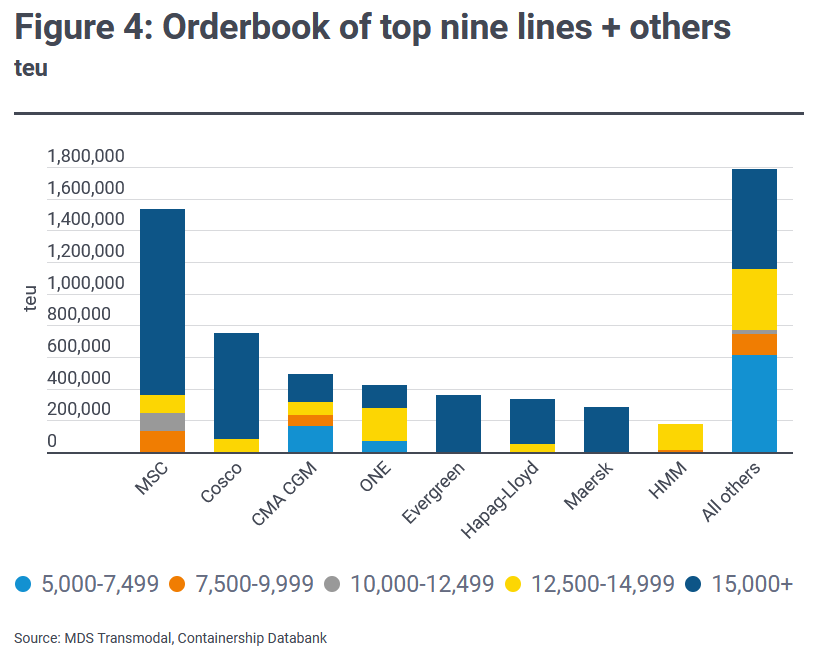

Before presenting the results of our analysis, it is worth noticing that the share of capacity offered by the top nine shipping lines operating in alliances increased from 83.5% in the first quarter of 2019 to 84.4% in the first quarter this year.

Some shipping lines have grown faster than others during this three-year period. Mediterranean Shipping Co has experienced the greater relative growth, while Maersk has reported the biggest decline, as shown in the following chart. MSC has since usurped Maersk to take the crown as the world’s largest container shipping line.

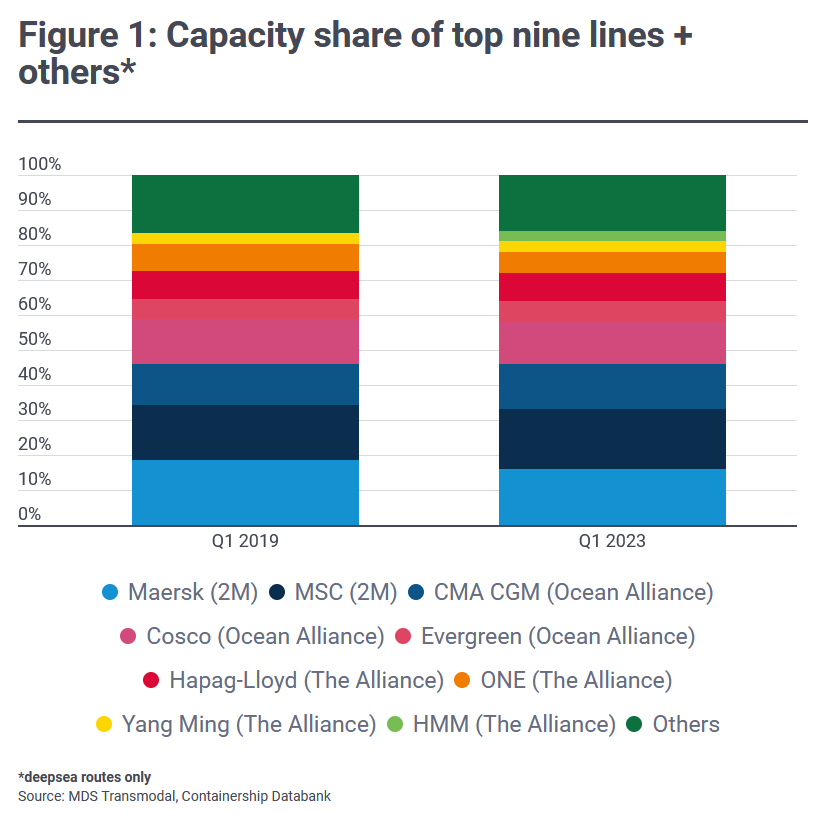

Focusing on the top nine shipping lines, MDST estimates that since 2019 the volume of capacity offered by consortia has declined significantly. This is evident considering both consortia within the same alliance, consortia with members of other alliances or consortia with shipping lines that are not part of any alliance. Conversely, capacity offered by the individual shipping lines has increased.

The results derived when looking at all top nine shipping lines taken together, however, are quite different when we drill down to an individual shipping line level — or at least for some shipping lines.

Capacity offered by A.P. Moller Holding AS alone has increased from 57% in 2019 to 75% in 2023, while the capacity offered with the shipping line’s members of other alliances has increased from 10% to 13% during the same period. This suggests that the announced termination of 2M does not mean termination of agreements with other shipping lines, at least not for now.

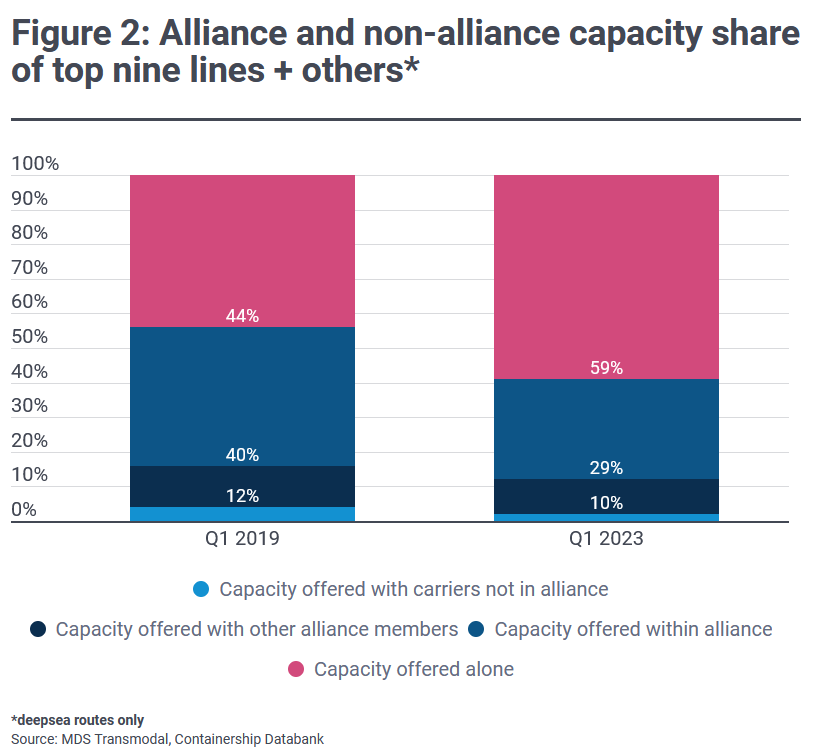

As for shipping lines not operating in alliances, the percentage of capacity offered by independent carriers has remained stable since 2019. However, while the capacity offered in consortia by shipping line members of alliances has gone down from 28% to 20%, capacity offered in consortia with shipping lines not in alliances has increased from 7% to 15%. This trend is an indication of the intention of smaller players to reinforce their collaboration to compete with the biggest players.

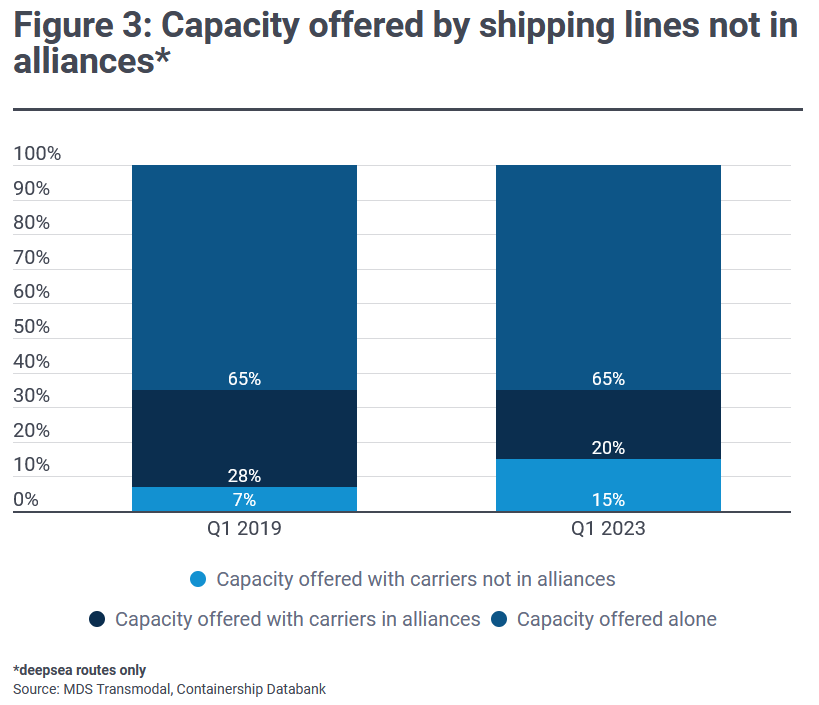

Given the significant level of capacity on order for the biggest players, especially for larger vessels (as illustrated in figure 4), alliances appear an almost superfluous tool for the biggest players, which, overall, are increasingly operating independently from each other. Meanwhile, the smaller players able to operate as part of an alliance is an important survival mechanism in a very concentrated market.

One take on the implications of the changes identified could be that with the intensification of vertical integration along with the hub-and-spoke networks increasingly adopted by the main players, consortia between smaller participants might cover the gaps for direct coverage between non-hub ports.