Changing Lanes:The cost of China’s energy crunch

- By Antonella Teodoro

- •

- 10 Nov, 2021

China’s energy shortage could see the price of goods and commodities spiral, adding further inflationary pressure

FROM food to automotives, from neighbouring countries to Western trading partners, it is difficult to think of a sector or a country that would not be impacted either directly or indirectly by China’s energy crisis if it persists.

The severe electricity shortage, caused by soaring coal prices, is bound to damage Chinese growth, further deteriorating the feeble state of the global supply chain and paralysing a global economy struggling to emerge from the lockdown-induced slump. And its timing could not be worse.

On top of everything we know about the current issues affecting the global supply chain, the energy crisis comes amid the harvest season in China.

With many Chinese factories cutting their production over the Golden Week holiday, the eyes of the world are now on whether the energy shortage will persist now factories are returning to full operation and on the actions that Beijing will put in place to limit its negative impacts.

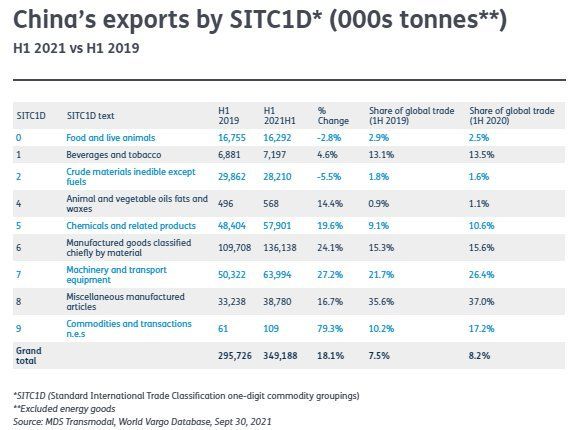

Based on the most up-to-date database available at the time of this analysis, the table below shows the commodity groups exported from China in the first half of 2021 as compared with the same period of 2019 (pre-pandemic).

The table also shows how much of global trade these volumes account for.

We estimate that, excluding energy goods, Chinese exports increased by more than 18% during the first six months of 2021 on 2019 levels. This increase has been circa 10 percentage points higher than the increase estimated for global trade.

The faster growth experienced by China has translated into a further increase of the country’s share of international trade. China now accounts for 8.2% of global trade, up from 7.5% in the first half of 2019.

China has seen an increase in its exports for all sectors except ‘Food and live animals’ and ‘Crude materials inedible except fuels’. These contractions, however, have not significantly affected China’s share of global trade for either of these markets.

It is also important to note that although Chinese exports of ‘Food and live animals’ only accounts for less than 3% of global trade, a disruption in production and storage of food products could negatively impact Asian economies.

China is estimated to account for 10% of the food products imported by the Asian countries, with vegetable and fruits accounting for more than 30%. The energy crisis could add pressure to food prices already on the rise, particularly during harvest season.

The recent surge in the quantity of purchases made online has been putting increasing pressure on the production of cardboard boxes.

Along with Germany and the US, China is among the principal producers of this product and, with the holiday season fast approaching, further complications and delays are the last thing businesses requiring packaging materials need.

Sectors heavily dependent on Chinese production that could also be affected by the Chinese energy crisis are the technology and the automotive sectors.

The world of technology could suffer dramatic setbacks, as China is the world's largest producer of devices from smartphones to game consoles as well as a major centre for semiconductors used as components for household appliances.

Should the energy crisis get worse, the production of these products could be heavily hit, thereby impacting on the crucial end-of-year shopping season. Auto-manufacturers could also suffer the negative impact of China’s energy crisis as its persistence could further deteriorate the shortage of chips.

Ultimately, goods are made and traded for the final consumer. At a time when wherever we look prices are on the rise, the overall concern is whether manufacturers and retailers will be able to absorb further cost rises and whether this latest crisis could become yet another factor in rising inflation.