Changing Lanes:Will pandemic reverse globalisation?

Supply chain issues have forced the container shipping industry to increasingly look to trade alternatives beyond their traditional deepsea routes

Analysis suggests that box imports into Europe and North America are no greater regionalised than in pre-pandemic times, while China’s dominant share of the global export market is waning as trade patterns shift in response to the supply chain crises

VIETNAM AND INDIA HAVE GAINED A SIGNIFICANT SHARE OF THE DEEPSEA MARKET AT THE EXPENSE OF CHINA DURING THE PANDEMIC.

THE resilience of global supply chains and the characteristics of container shipping have been under enormous pressure in the past two years, as the industry focuses on how to manage immediate issues while looking for longer-term solutions to ensure operational fluidity and prepare for future supply chain crises.

Freight backlogs, vessel delays, rate increases, a reduction in the number of maritime services and port calls are among the major problems suffered by global shippers.

They face a strategic dilemma of whether to restructure their production/distribution strategies and relocate factories (opting for nearshoring, reshoring, or regionalisation) or to stay put and await the ‘storm’ to pass.

Without knowing the thinking process of individual companies, which will vary depending on which sector they are in and how consolidated their network is, MDS Transmodal examines the state of play of both regionalisation and multi-sourcing production. Are European and North American consumers buying more locally now than two years ago? And is China still the global major source of goods?

Based on our most up-to-date World Cargo Database available at the time of this study, we have analysed the volume of goods imported into North Europe & Mediterranean, and into North America, making a distinction between the flows from deepsea markets and the shortsea market in the third quarter of 2021 compared with the same three months in 2019.

To assess whether the changes in the last two years could be due to the latest events affecting the shipping industry or whether they should be considered as a continuation of trends already in place, we have compared the changes between the third quarters of 2019 and 2021 to the changes between the same three months in 2016 and 2019.

Two years is too short a period to arrive at definitive conclusions and findings should be treated with caution. However, we believe a comparison between the trends of the last two years with those in place between 2016-2019 should offer insight into the potential development of globalisation and international trade.

Excluding live animals, energy goods and minor unspecified goods, we estimate that in third-quarter 2021 circa 78.5% of the unitisable goods imported into the North European & Mediterranean countries arrived from the shortsea market, down from 79.5% in third-quarter 2019 and even lower than the 80% we estimate for Q3 2016.

The magnitude of the decline shows that overall, the European market today has not become more ‘regional’ than it was a few years ago. Also, drilling down into the analysis to the commodity groups imported into this market, we estimate that the commodity groups to have experienced an increase in the proportion moved shortsea are ‘Food’ and ‘Mineral manufactures’, i.e. perishable goods and materials (such as marble) for which the origin is difficult to replace respectively.

The results of our analysis are shown in the following tables.

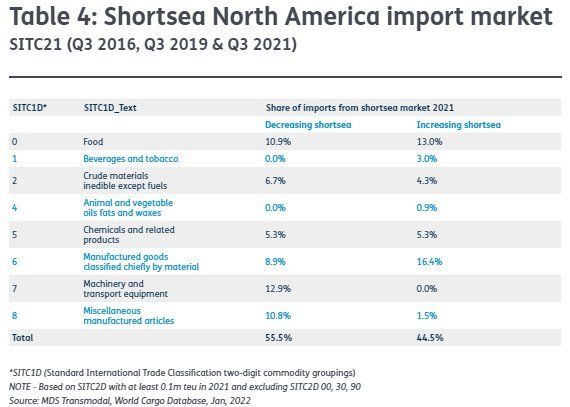

For North American imports, the decline in the share of goods imported from within the same region has been larger between the third quarter of 2016 and Q3 2021.

More specifically, MDST estimates that North America countries imported more than 38% from their shortsea market in third-quarter 2016 and 33% in Q3 2021.

The most significant decreases were estimated to be in SITC2D 78, ‘Furniture’ and SITC2D 78 ‘Road vehicles’ (accounting respectively for circa 7% and 10.6% of the total shortsea volume imported by North America in Q3 2021).

The results of our analysis for North America is shown in the following tables.

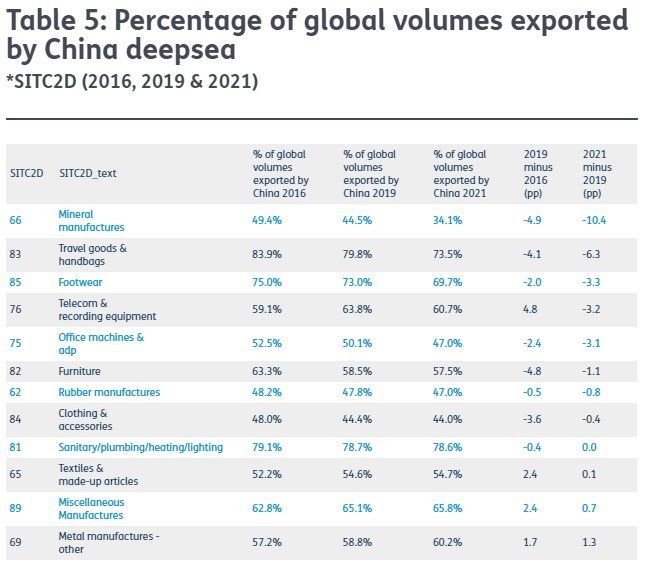

In order to answer our second question (i.e. whether China remains the global major source of goods), we have identified the commodity groups for which China exported to deepsea markets at least 100,000 teu in third-quarter 2021 (these commodities together represented circa 90% of the total Chinese exports in Q3 2021) and analysed how much of these volumes accounted for the global trade in Q3 2021.

We have then compared these percentages with those estimated in Q3 2019 and Q3 2016 to assess the magnitude of change (if any) over time.

The results of our analysis are shown in the following tables.

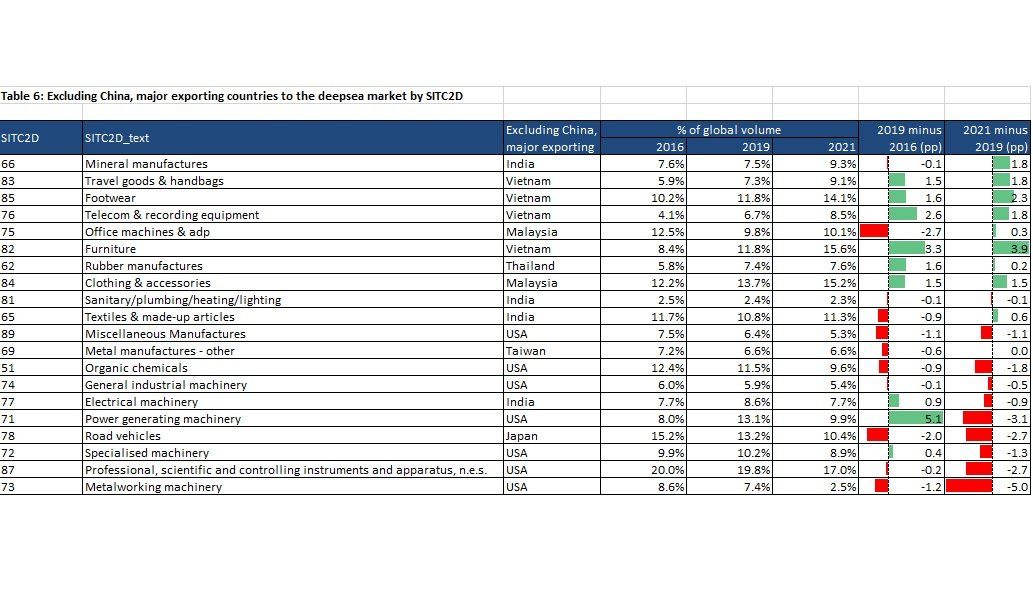

Table 6 shows the percentage of volume moved to deepsea markets by countries other than China.

From this table it emerges that China is indeed losing market share, with Vietnam and India amongst the principal ‘winners’.

Our analysis seems to suggest that the two major consumer markets (Europe and North America) are no further regionalised than a few years ago.

However, any significant shift from the structure in which international trade operates today to a less globalised one is not going to be easy or quick, as the labour skills and investments required (among other factors) to have efficient and feasible alternatives would take longer than two years.

The extent of the crisis currently affecting the global supply chains, both in terms of its duration as well as in the degree of pain suffered by some companies, is such that governments might be prompted to intervene and provide incentives to critical industries — the pharmaceutical industry could be one — to facilitate regionalisation.

Changes in the current production/distribution networks could also be promoted by incentives to companies that move productions out of China, like those put in place by Japan and India.

Geopolitics is, therefore, a factor to keep an eye on, as its role in modifying the underpinning mechanism of international trade as we know today may become more significant

The complete tables 1, 3, 5 and 6 are available on the Lloyds List website