Deepsea box fledglings cut capacity following rate rot

- By Antonella Teodoro

- •

- 28 Sep, 2022

New container lines are maintaining a healthy presence on intra-regional trades

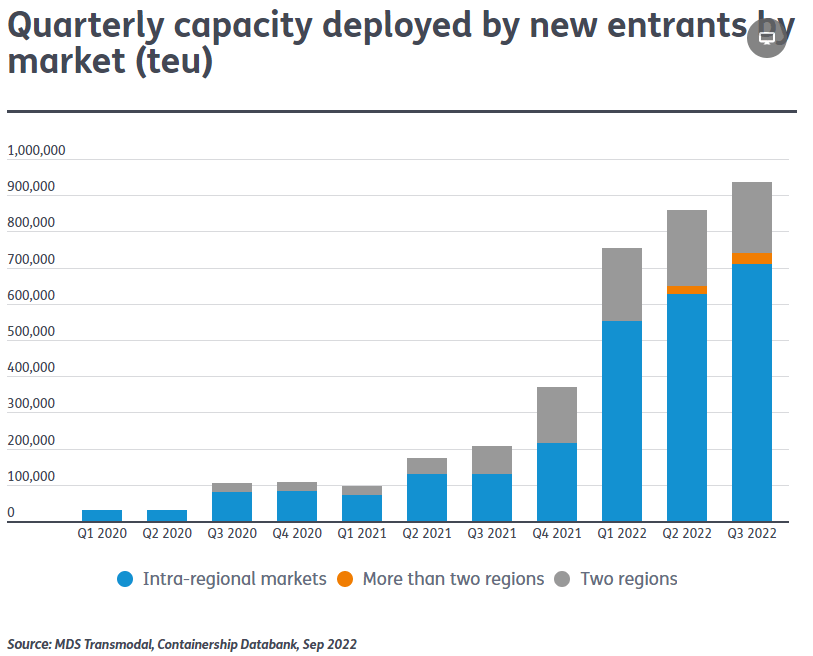

The lockdown-induced market boom on box trades spurred a host of new smaller industry players looking to take advantage of the sky-high rates off the back of unprecedented demand.

Despite new entrants reaping the rewards of initial sky-high rates, the danger was always that when the market corrected itself, bearing higher operating costs and often little contract protection came at significant risk, according to UK-based analysts MDS Transmodal.

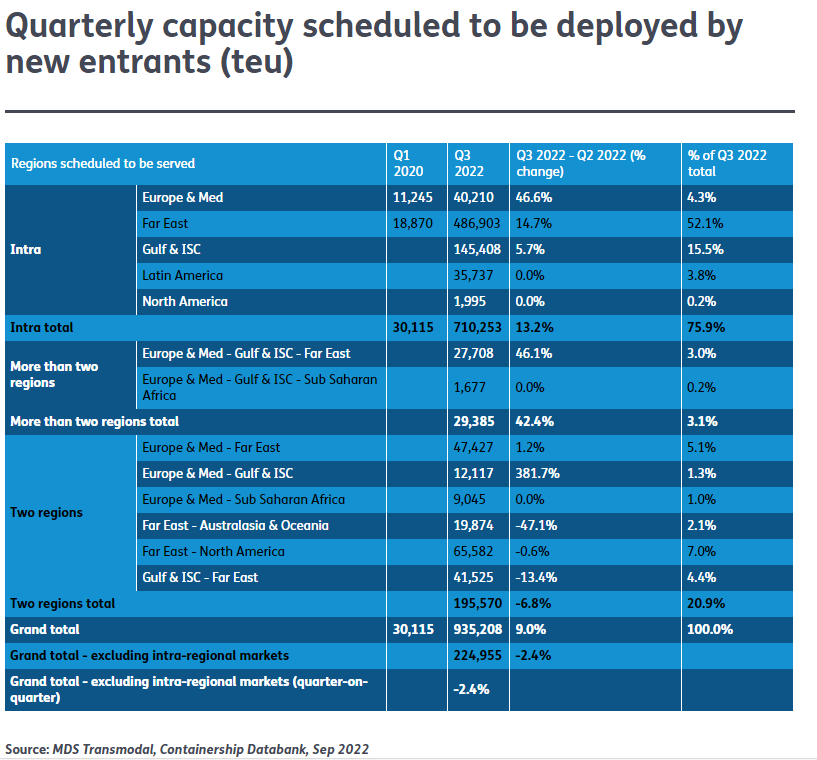

It estimates that in the third quarter of 2022, the percentage of capacity — excluding intra-regional services — offered by new lines that began services from the first quarter of 2020 was down 2.4% on the previous quarter.

This trend was driven largely by a 13% drop in capacity offered on

the Middle East Gulf/Indian Subcontinent–Far East trade lane during the

period.

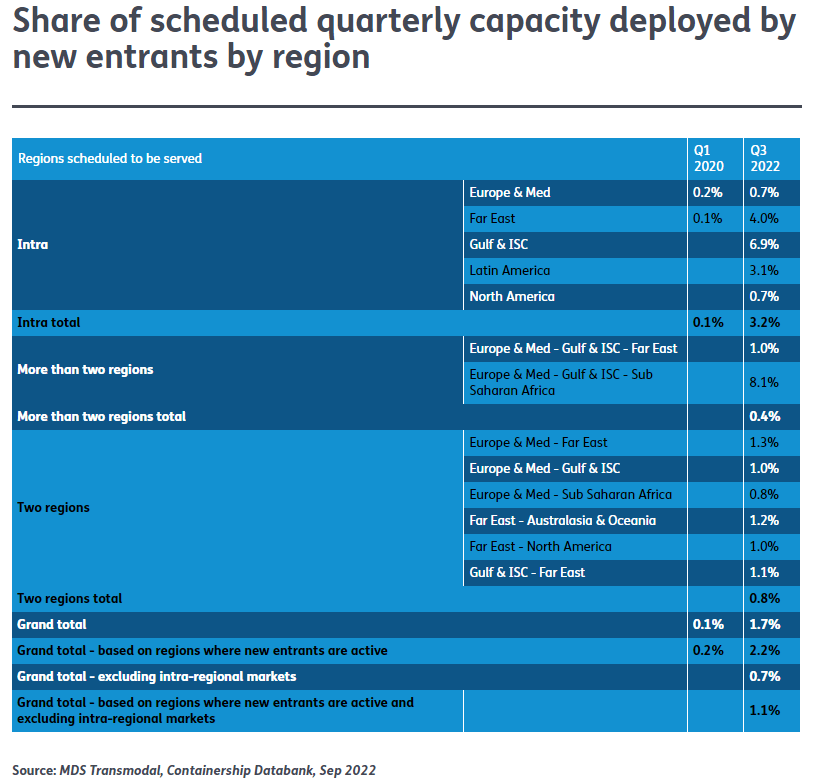

In

the context of global capacity, however, ‘new entrants’ still account

for relatively modest percentages; 0.7% of overall capacity and 1.1%

offered only in the regions where they are active.

By contrast, new entrants appear to be increasing their offer in the

intra-regional markets, although this should not come as a surprise

considering these markets have experienced the largest reduction in

scheduled capacity offered by the major container shipping lines.

Including intra-regional services, the proportion of capacity offered by

new entrants increases to 1.7% in terms of overall capacity and to 2.2%

in regions where new entrants are active.

The market estimated to be the most attractive for the new entrants is the intra-Far East, accounting for more than half of the total capacity offered.

This trend has been spurred too by the recent relaxation of Chinese cabotage rules, as well as increasing demand for new services to support growing manufacturing activities outside China particularly in Southeast Asian countries.

Despite the increased capacity offered by the new entrants, the overall

capacity deployed on the intra-Far East in the third quarter of 2022 is

estimated to be more than 5% lower than that deployed in at the start of

2020.

That suggests that while attractive to new container lines — for whatever reason — the capacity offered is still not sufficient to completely cover the gaps left by the major shipping lines.