CLdN’s acquisition of Seatruck Ferries

- By Chris Rowland

- •

- 06 Oct, 2022

Following the trials and tribulations of coping with the UK’s economic exit from the European Union on 1st January 2021 and the on-going uncertainty about negotiations on the Northern Ireland Protocol, the latest development in the Irish Sea RORO market is the acquisition of Seatruck Ferries by CLdN which was announced on 20th September. This continues a general trend for consolidation in the European RORO industry, but may not cause competition concerns in the Irish Sea market.

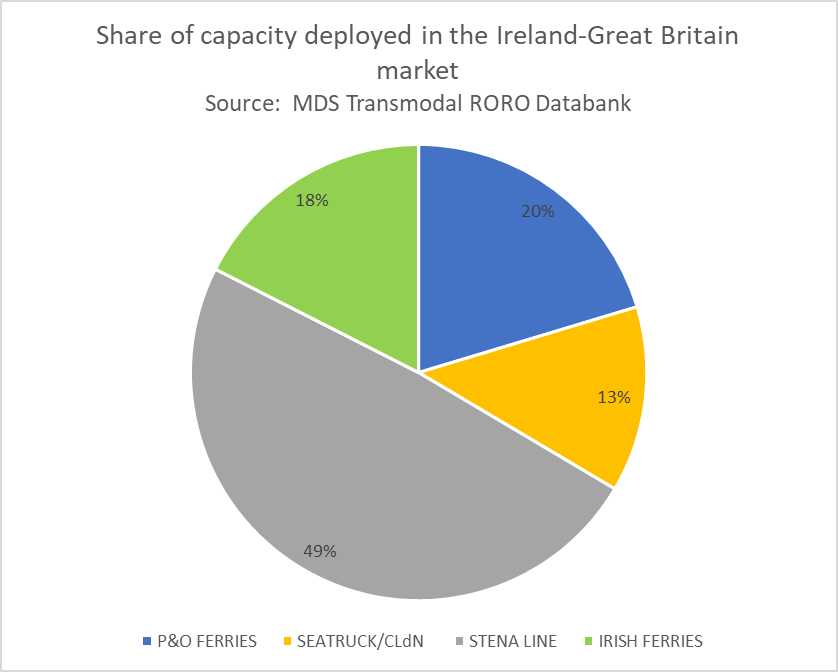

The acquisition is subject to the agreement of the Irish competition authorities, but data from MDS Transmodal’s RORO Databank shows that Seatruck has 12.7% of the capacity in the GB-Ireland RORO market, while CLdN only has minimal presence in this market with a weekly service between Liverpool and Dublin.

Even if the

relevant definition was all ROPAX and RORO services to and from the Republic of

Ireland’s ports, including direct services to the continental mainland where

CLdN has a much greater market presence, the combined market share is only

23%.

Putting the

competition issues to one side, there is generally a good strategic fit between

the two companies, with the creation of a single large-scale operator

specialising in transporting unaccompanied short sea traffic on the Irish Sea

in competition with the established ROPAX services and short sea container

services.

The business

models of the two lines are not, however, identical with CLdN offering a

door-to-door service and Seatruck focusing on quay-to-quay. Seatruck’s fleet of eight vessels of up to

2,166 lane metres are designed to maximise the economies of scale available at Heysham

in Lancashire rather than the deeper water ports at Liverpool and Dublin and so

may be regarded as relatively small by the Luxembourg-based company, which

deploys ships of up to 8,000 lane metres.

The acquisition does, nevertheless, provide CLdN with two established

routes across the Irish Sea along with the accompanying existing relationships

with customers in the GB-Ireland market.

The major prize for CLdN may, however, be the greater access it provides to the two deepwater Irish Sea RORO ports of Liverpool and Dublin. Brexit has also increased the proportion of Ireland-Continent trade that bypasses the British land bridge on longer distance services, which plays to CLdN’s strengths with its ‘Brexit-busting’ RORO services between Dublin and Rotterdam, Zeebrugge and the Iberian peninsula and provides an opportunity to tranship trailers via Dublin for the British market.