Global Shippers Forum tool up for the contracting season

- By Nick Savvides (Seatrade Maritime News)

- •

- 26 Sep, 2024

Global Shippers Forum (GSF) Director James Hookham will tell the FIATA World Congress in Panama today about new reports and indices the GSF is comping with MDS Transmodal to improve transparency.

Cargo owners have taken a battering over the past five years as major events, such as Covid and the blocking of the Red Sea route, have sent freight rates to unprecedented levels. And the feeling, among some shippers is that the lines have taken advantage of massive disruptions to bolster their bottom lines.

Following last year’s false dawn, which saw the Middle East war erupt, closing the Suez route, forcing carriers around the Cape of Good Hope absorbing newbuilding capacity that had been expected to rebalance the supply and demand equation, shipper confidence is again growing.

In some senses many shippers have entered previous contract negotiations with little market visibility, but the GSF in partnership with consultant MDS Transmodal have designed a report that is aimed at giving shippers the visibility of what is happening in the market, arming shippers with data that they can use in the upcoming rounds of negotiations.

Those trends will initially take the form of quarterly market reports compiled by MDS Transmodal using publicly available sources and the company’s own algorithms to detect those trends and inform shippers.

According to Hookham, shippers are looking for three things from this data, the numbers to use when they are in discussions with the shipping lines; to understand trade routes more fully, so that when a problem arises they can rapidly assess their options; and when considering re-sourcing to other parts of Asia or closer to the consumer market, what are the available services, what is the quality of those services and can they make a detailed risk assessment before taking major decisions.

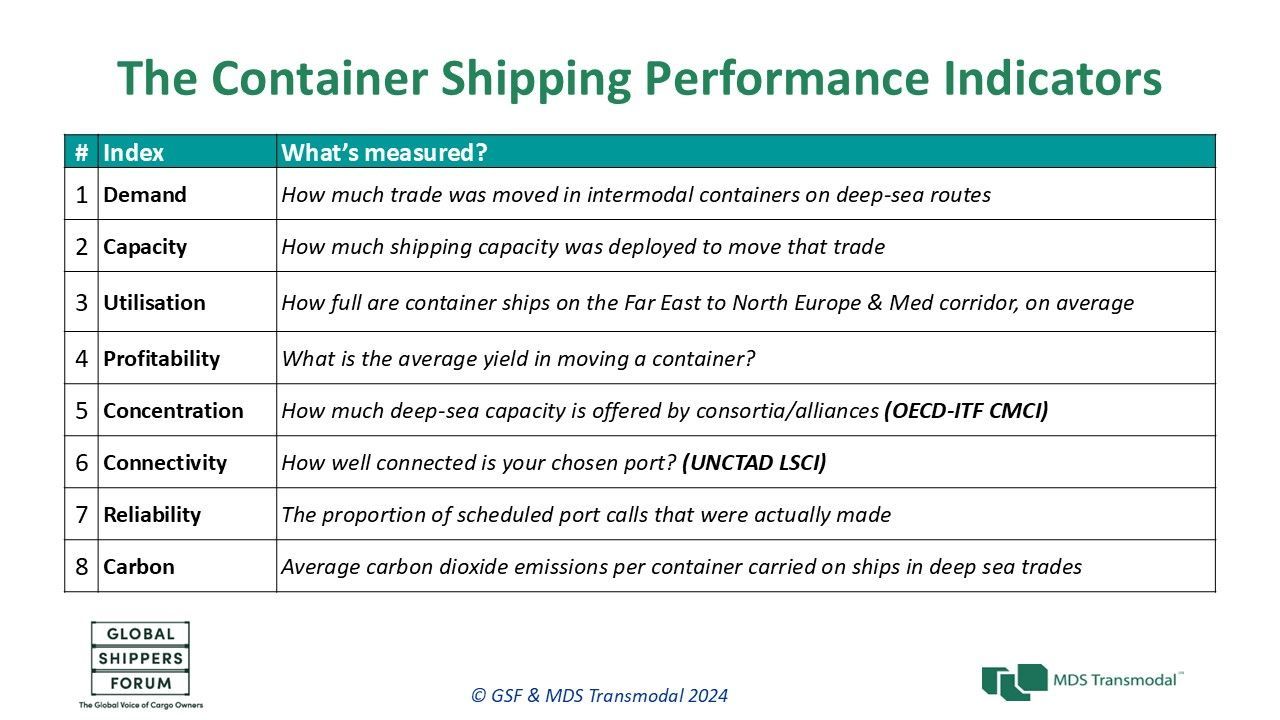

As a tool to help shippers answer these questions GSF and MDS Transmodal have put together the Container Shipping Performance Indicators CSPI which has eight indices, three of which, capacity, profitability and connectivity will be presented by Hookham in his Panama speech today. (see below for full indices).

“The number of slots available are a quarter of the given capacity on the water,” claimed Hookham, “but the amount that can be booked will depend on the speed of the vessel, the frequency of port calls, which ports and how many are skipped and blanked sailings, as lines manage the actual capacity and number of slots.”

Development of the CSPI began during Covid and has now matured with new elements expected to be added to the system in the near future.

In the immediate future, however, shippers will be able to use data supplied by a variety of sources, including capacity and utilisation data, which Antonella Teodoro, the analyst at MDS Transmodal responsible for building the CSPI, says had already had an effect.

“Data from the embryonic CSPI was used to analyse the market and that was presented to the EC leading the commission to end the carriers’ block exemption from the European competition rules,” said Teodoro.

In the latest developments MDST has started by following vessel deployments, through its database, which is updated on a monthly basis and allows the consultant to accurately measure capacity. That data is supplemented with trade flow data to calculate average utilisation for capacity deployed, explained Teodoro.

Latest CSPI data suggests that carriers on the headhaul routes of the three major trade lanes have adequate spare capacity to carry cargo, with Pacific utilisation at 70%, Asia to Europe 80% and utilisation of just 65% on the westbound Atlantic.

“There is likely to be severe over-capacity by February next year with the newbuild capacity being deployed, there will likely be disruption from the US East Coast strike, but I don’t think this will be serious enough, or long enough, to bring similar levels of disruptions as seen during the pandemic,” said Teodoro.

According to MDST standing capacity is expected to increase by 1.7 million teu by February next year, from a global total of around 29.9 million teu to close to 31.6 million teu.

Some of this newbuild capacity will be offset by demolitions, but most scrapping will begin with older tonnage, meaning smaller vessels, while the bulk of the orderbook remains for ships in excess of 15,000 teu.

Teodoro, meanwhile, confirmed: “In 2020 there were virtually no vessels available and utilisation was over 90% this is a major difference between then and today’s market.” Ultimately that lack of available tonnage drove rates to record levels.

All the indications are that barring a major cataclysmic event similar to Covid, a major slump in spot rates is on its way from Q4 onwards and could impact contract negotiations in the Aisa to Europe trades which are due to begin imminently. And if that happens a knock-on effect may be seen on the Pacific, with all three major trades having already seen the market softening.