Global steel trade 1996–2024: Trends, shocks, and UK exposure

Introduction

Global trade volume: Growth and shocks

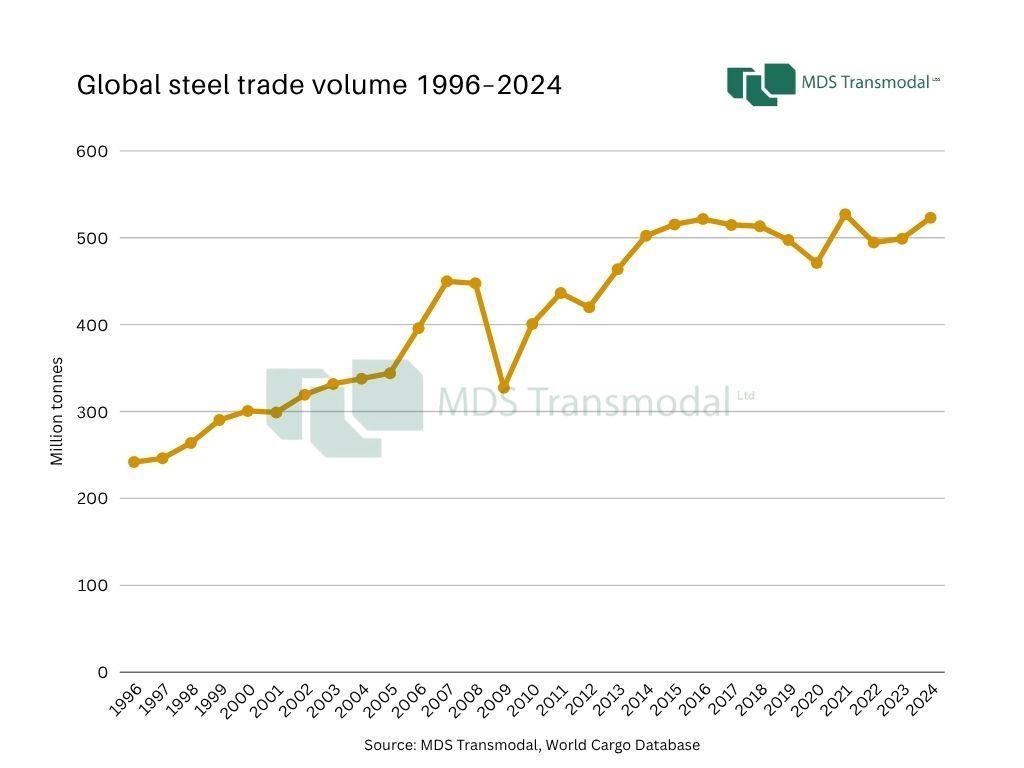

Over the past three decades, global steel trade has experienced strong long-term growth, rising from 242 million tonnes in 1996 to 523 million tonnes in 2024. This expansion, however, has not been linear. Significant disruptions punctuated the growth trajectory, including the 2008 global financial crisis, which caused a sharp contraction in trade, and the COVID-19 pandemic, which temporarily reduced production, shipping, and demand. Amid these shocks, structural shifts in global supply emerged, most notably China’s surge in exports. This expansion not only transformed China into the world’s largest steel exporter but also reshaped the competitive dynamics of the global market, forcing other exporters to diversify markets and adapt to an increasingly concentrated production base.

Top exporters: China’s dominance

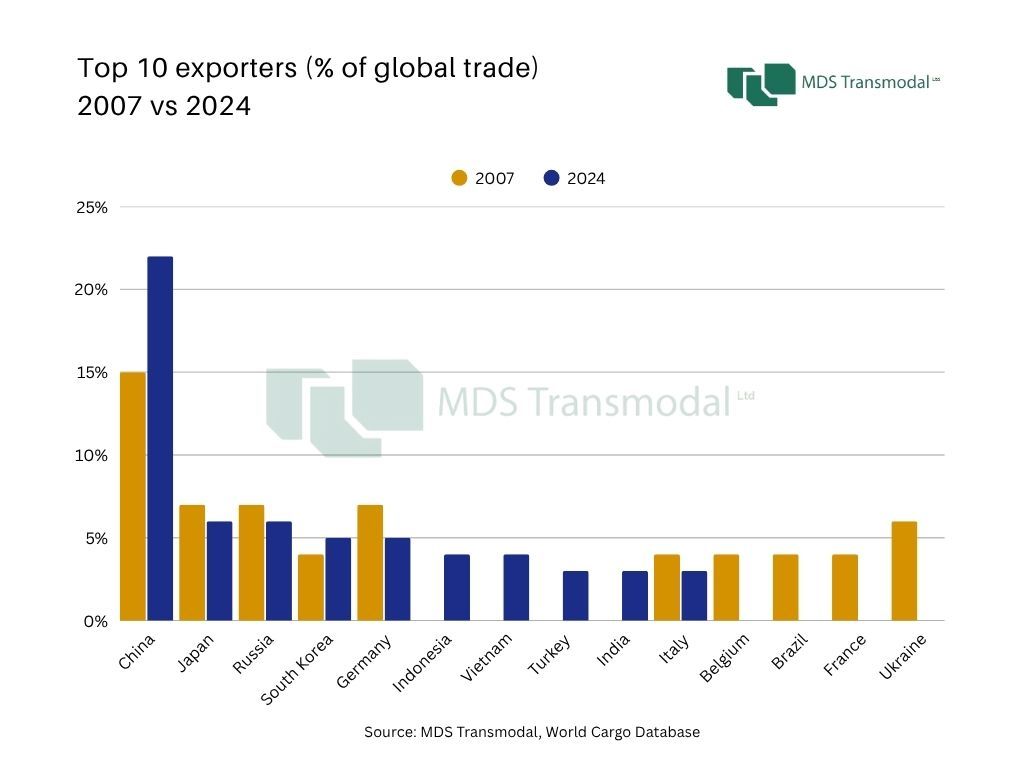

China’s impact on global steel trade is striking. In 2007, China accounted for 15% of global exports; by 2024, this had increased to 22%. Meanwhile, traditional exporters such as Japan, Russia, and Germany experienced a gradual decline in relative share, reflecting the combined pressures of China’s expansion, regional industrial shifts, and competitive overcapacity. Other markets, particularly South Korea, Vietnam, and Indonesia, have grown in importance, indicating a diversification of export origins beyond the traditional European and Far Eastern hubs. India has also emerged as a significant exporter, doubling its shipments from 7.46 million tonnes in 2007 to 14.74 million tonnes in 2024. The Gulf and Indian Sub-Continent region receives the largest share of Indian exports, followed by the EU27 and the Far East, highlighting India’s growing influence in key strategic markets. Even shipments to the UK have increased substantially over the period, reflecting India’s expanding production capacity and integration into global steel supply chains. These developments illustrate how structural changes in production and industrial strategy can reconfigure global trade patterns over relatively short periods.

Top importers: Shifting demand

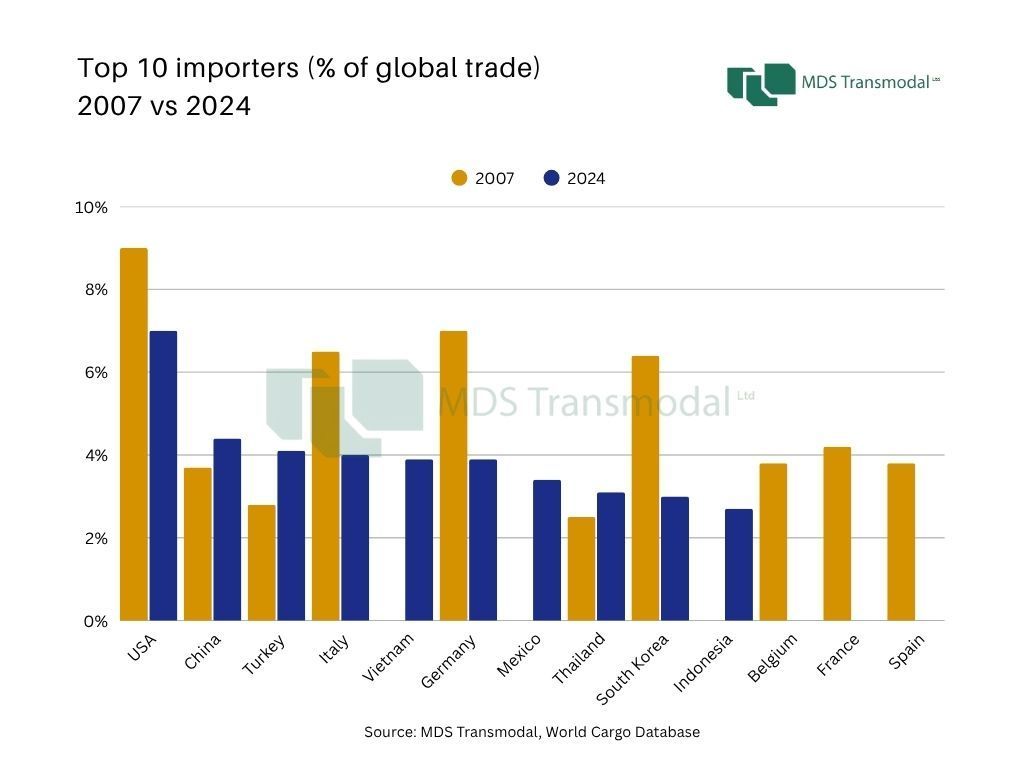

The composition of global steel importers has evolved alongside export patterns. The United States remains one of the largest importers, though its share has fallen from 9% in 2007 to 7% in 2024, reflecting both increased domestic production and changing industrial demand. European countries, particularly Germany and Italy, continue to be major destinations, underpinning the continent’s industrial base. At the same time, Southeast Asian markets have emerged as significant growth regions. Countries such as Vietnam, Thailand, and Indonesia have experienced rapid import growth, driven by industrial expansion, infrastructure development, and deeper integration into global supply chains. This rebalancing of demand underscores the increasing importance of emerging economies in shaping global trade flows and highlights the strategic need for exporters to diversify beyond traditional Western markets.

Regional trade flows: the UK and EU perspective

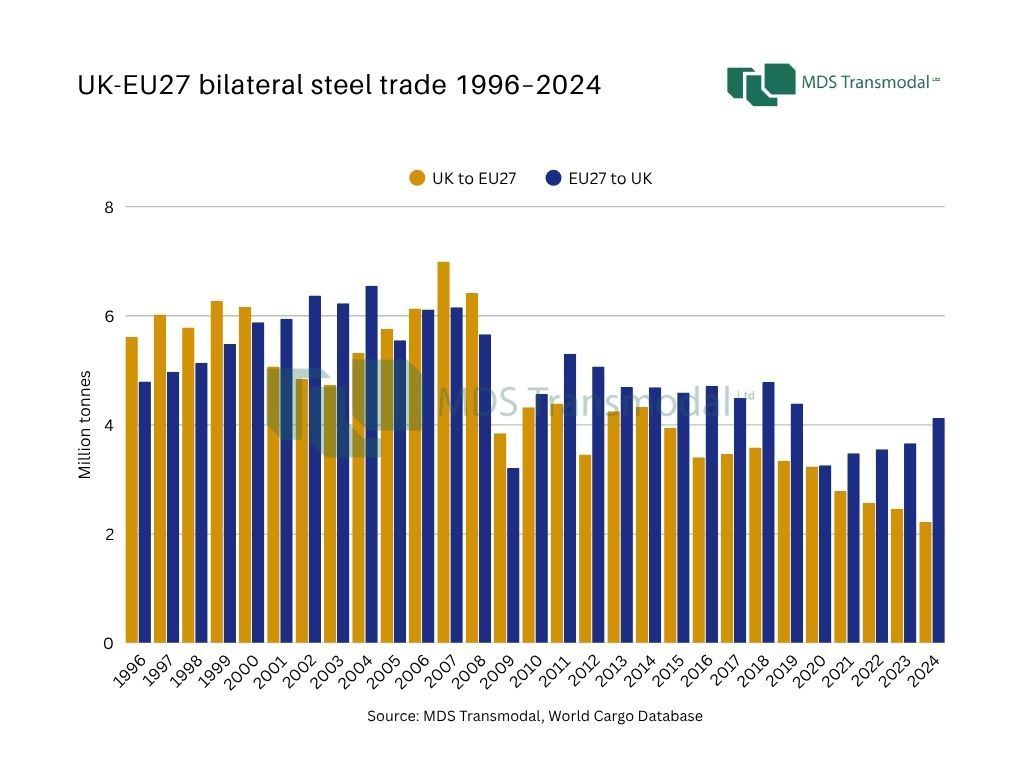

Regional trade flows further illuminate the strategic dynamics for the UK and EU. Bilateral trade between the UK and EU27 has become asymmetrical in the post-Brexit era. UK exports to the EU fell to 2.2 million tonnes in 2024, while imports from the EU rose to 4.1 million tonnes, reflecting a growing trade imbalance. Despite this asymmetry, the EU27 remains the UK’s largest export market, accounting for approximately 76% of total UK exports in 2024. Meanwhile, as blast furnaces in the UK have closed, imports from the Far East, particularly China and Southeast Asia, have surged for both the UK and EU, increasing exposure to volatile external supply conditions. This highlights the strategic importance of maintaining diversified trade relationships to mitigate reliance on any single market or region.

India’s growing role in global steel trade further exemplifies the changing supply landscape. Indian exports have increased across multiple regions, with the Gulf & ISC region receiving the largest share, but substantial shipments also reaching the EU27 and Far East markets. Exports to the UK have quadrupled since 2007, demonstrating India’s integration into established industrial markets and Tata Steel’s ownership of the rolling mills at Port Talbot and Llanwern in South Wales. Alongside China, India’s rise as a key supplier strengthens the diversification of global supply, while simultaneously increasing the competitive pressure on traditional exporters.

Strategic implications for the UK

The evolving global steel trade carries significant strategic implications for the UK. Heavy reliance on EU27 markets for exports exposes the UK to shifts in EU industrial demand, trade policies, and regulatory alignment. Simultaneously, rising import penetration from China, India, and Southeast Asia introduces both competitive pressure and potential supply chain risk. The export asymmetry with the EU27 underscores a structural trade imbalance that may influence domestic industrial strategy, pricing, and market positioning. For policymakers and industry leaders, these dynamics necessitate a proactive approach, balancing trade policy, investment in domestic capacity, and diversification of both suppliers and export destinations - exemplified by the UK Government’s direct action in spring 2025 to ensure the UK’s last remaining blast furnaces in Scunthorpe remain open.

Conclusion

Over the past three decades, global steel trade has transitioned from a relatively liberalized and steadily growing market to one characterised by intense strategic competition, protectionist measures, and structural realignments in production and consumption. China now dominates exports, India has emerged as a rising key supplier, and Southeast Asia has become a major importer, reflecting shifts in global industrial geography. US and EU trade measures continue to reshape flows, creating both risks and opportunities for UK businesses. For the UK, the combination of export asymmetry with the EU27 and growing exposure to the Far East underscores the need for a proactive, strategic approach to trade and industrial policy. Maintaining competitiveness will require careful navigation of international supply chains, continued engagement with European partners, and forward-looking industrial strategies that embrace resilience, diversification, and opportunity.

Stay ahead of global trade dynamics, contact us for tailored analysis at

web.enquiries@mdst.co.uk.