MSC and Maersk: the end of 2M

- By Antonella Teodoro

- •

- 10 Feb, 2023

On January 25th, the world's largest container shipping companies, the Swiss-based Mediterranean Shipping Company (MSC) and Denmark's Maersk announced they were to terminate their vessel sharing agreement, the 2M alliance, in January 2025.

The end of 2M, which

was launched in 2015 for a minimum term of 10 years with a 2-year notice

period of termination, has been anticipated for quite some time - despite the

lines’ refusal to confirm any forthcoming termination of the agreement.

Bolstered by record profits from astonishing

container freight rates in the last few years, each of the top two shipping

lines, conscious of their increasingly dominant positions in the shipping

industry, have been shaping their future beyond that alliance. They have been

doing this on two levels: differentiation in the type of investments put in

place and differentiation in the services offered.

On the investment side: the Danish

shipping company aims to undertake, in a more decisive way than MSC, a path of

door-to-door integration, acquiring customs brokerage companies, warehouse and

distribution specialists, structuring its own land transport offer, investing

in logistics platforms and thus reducing its dependence on the ocean transport

sector. MSC, on the other hand, remains focused on the ocean side: thanks to an

aggressive strategy aimed mainly at increasing its fleet and, therefore,

increasing the overall capacity offered. In January 2022 MSC overtook Maersk to

become the largest shipping company in the world. Today MSC has an orderbook

that represents circa 40% of its current capacity, compared to less than 10%

for Maersk.

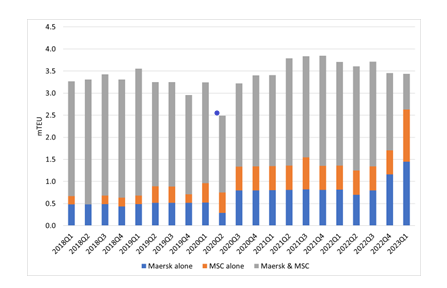

On the operational side: focusing our attention on the services presented as “2M” services, in the last few quarters, the two companies have been reducing the level of capacity offered jointly in these services. In the third quarter of 2022, the two carriers individually provided connection services for a total capacity of 1.3 million TEU, equal to 36.2% of that deployed overall under the VSA; in the last three months of the year this percentage increased to 49.4% (1.7 million TEU out of a total of 3.5 million TEU). This percentage is expected to grow even further during the first quarter of 2023 – our projection is for this ratio to exceed 76%. Our estimates are shown in Figure 1.

The decision by Maersk and MSC not

to extend their collaboration beyond 2025, however, should not be confused with

a position of absolute independence: it is reasonable to assume that the two

companies will continue to offer services in consortia - with other companies

and perhaps with each other - as long as the regulators allow.

Liner shipping is, however,

dependent on the scale of demand for ocean-going transport of goods. China’s

place in world trade is a key factor to consider in speculating on what might

happen.

In the last few years, a possible

diminishing role played by China in international trade due to

reshoring/nearshoring/friendshoring has been mooted. Producing goods closer to

the final markets would favour railways and more integrated logistics offers,

which would suit Maersk’s strategy. Alternatively, if China’s dominance in

manufacturing was to be increasingly substituted by other Asian countries, more

transhipment could be required, which would suit MSC’s strategy.

China, however, will not remain passive.

Cosco, currently the world’s fourth-largest shipping line by capacity, might

opt for a third strategy: to pursue more horizontal integration (by acquiring

more shipping lines) while also progressing its vertical integration (by

acquiring more container ports).

Nobody can declare with certainty

what the outcomes of the 2M decoupling will be; what is sure is that the

strategies of the two shipping lines will have to face continuing complex

geopolitical challenges.