UK Trade: Is Kazakhstan a major back door route for UK car exports to Russia?

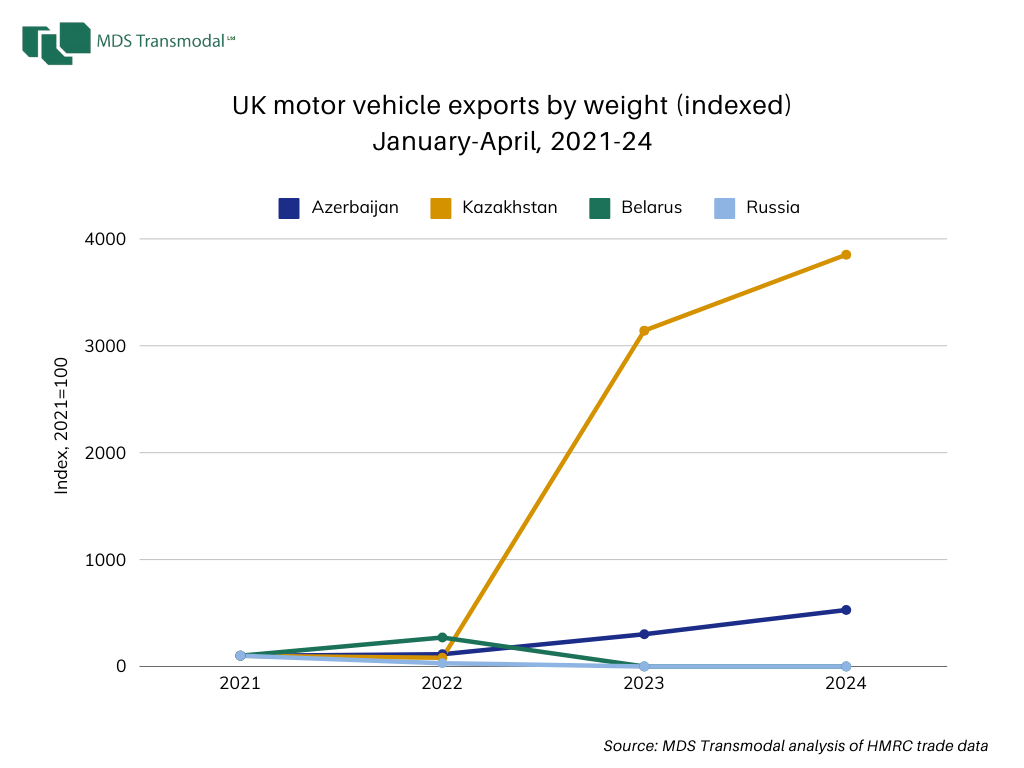

The analysis of UK exports of cars to Russia and some of its neighbours highlights the huge percentage increases in UK automotive exports since February 2022 to countries such as Kazakhstan following the invasion of Ukraine. Commentators have suggested this represents intermediate trade between the UK and Russia via Kazakhstan to avoid sanctions. Does analysis of the trade by weight and in absolute terms, rather than by value and in relative terms, suggest this is a major potential circumvention of Western sanctions against Russia?

After February 2022 British car manufacturers ceased their operations in Russia, with sales of luxury cars worth more than £42,000 banned under the sanctions introduced after the Russian invasion. UK trade statistics show that no cars at all were exported directly to Russia in 2023 and 2024.

At the same time, however, UK automotive exports to Kazakhstan grew by 3,900% in the period January-April 2023 compared to the same period in 2022 and by 123% in the first four months of 2024 compared to the previous year. The Kazakh economy grew at 5.1% in 2023, a healthy rate in its own right, but there was no sudden increase in per capita wealth to explain such an enormous percentage growth in car imports from the UK. Commentators have suggested that the growth was due to the Russian market for luxury cars being served via intermediaries in countries such as Kazakhstan, which shares a 7,600km land border and a customs union with its northern neighbour.

Analysis of the weight of the cars exported to Kazakhstan suggests that - while some intermediate trade is possible - it in no way makes up for the direct trade lost with Russia. Assuming that cars exported to Russia are 2 tonnes per vehicle (the average weight of a car), the UK’s exports to Russia amounted to about 68,000 vehicles in January to April 2021, but had fallen to 21,000 cars in the first two months of 2022 before sanctions were introduced.

Between January to April 2022 and the same period in 2023, estimated exports to Kazakhstan increased by 3,900% but this represented an increase from only 3 vehicles to 133, with a further increase to 163 in the same period in 2024. These 163 vehicles represent only 0.24% of the UK’s sales to Russia during the same period in 2021 and shows that any intermediate trade is relatively small-scale and probably meeting the requirements of a small number of wealthy Russian citizens who are desperate to drive a particular British marque.

The real story behind the headlines on the massive percentage increase in UK car exports to Kazakhstan is how successful the sanctions have been in stifling the flow of British cars to all but a few very wealthy Russian consumers.