VIEWPOINT - PORTS

SERVICES

MDS Transmodal launched its Freight Data Hub at the Modelling World Conference in Birmingham on 9th June 2022. The Freight Data Hub is a new way for the public sector, transport planning consultants and commercial organisations in Great Britain to access high quality and robust freight transport data. It directly addresses the need for “new and better data” on freight that was originally asserted by the National Infrastructure Commission in 2018 and now partially endorsed by the Department for Transport’s Future of Freight: a long-term plan which was launched by Trudy Harrison MP, Parliamentary Under Secretary of State for Transport on 15th June.

The DfT’s Future of Freight: long term plan sets out a key strategic goal of ”A planning system which fully recognises the needs of the freight and logistics sector, now and in the future, and empowers

the relevant planning authority to plan for those needs. The Government is intending to update the guidance for Local Transport Plans to ensure that freight needs are key considerations in Local Transport Plan-making. As a contribution to the evidence that local authorities can draw on, the Freight Data Hub service provides free data for each of 80 unitary authorities, county councils and combined authorities in England that are responsible for producing local transport plans and strategies in England.

This free data provides

information on the annual movement of HGVs to and from the local authority

area, the number of large-scale warehouses and aggregate floorspace in the area

and the top three ferry or container ports that serve the trade to and from the

area. It provides a heat map of the

origins and destinations of HGVs for each area.

Freight Data Hub

also provides a digital resource that sets out the wealth of

freight transport data that is available and how it can be used effectively

within Local Transport Plans, including alongside passenger data in local

highways models, and to develop specific freight strategies for local areas.

The

free freight data for local areas can be accessed via:

Under Great British Railways (GBR) , the proposed new public rail body, rail freight will remain largely in the private sector, though the Williams-Shapps Plan states that the sector will benefit from national coordination and a new rules-based access system. GBR will have a duty to promote rail freight. There is also a Government commitment to set a national rail freight growth target, as has already been done in Scotland, and the GBR Transition Team (GBRTT) has been asked by the Secretary of State to develop a range of growth target options. To inform this process, on 5 July 2022 the GBRTT published its Rail Freight Growth Target Call for Evidence.

The purpose of the Call for

Evidence is to develop an understanding of how much of the current and future

market demand for freight could be met by rail.

To understand the realistic scope for modal shift to rail, GBR needs to

develop an understanding of the:

1. Volume of goods that could be moved

by rail;

2. Where the potential for future rail freight traffic exists;

3. Where suppressed demand exists on the rail network; and

4. Where further work is needed to establish new rail terminals.

The Call for Evidence document

notes that GBR’s current understanding of rail freight growth is derived from

industry demand forecasts produced by MDS Transmodal for Network Rail in

2020. Six scenarios (A-F) were

undertaken reflecting a range of growth and economic factors, Scenario E being

the ‘central’ forecasts. The table below

summarises the headline outputs and for three key sectors (central Scenario E

highlighted).

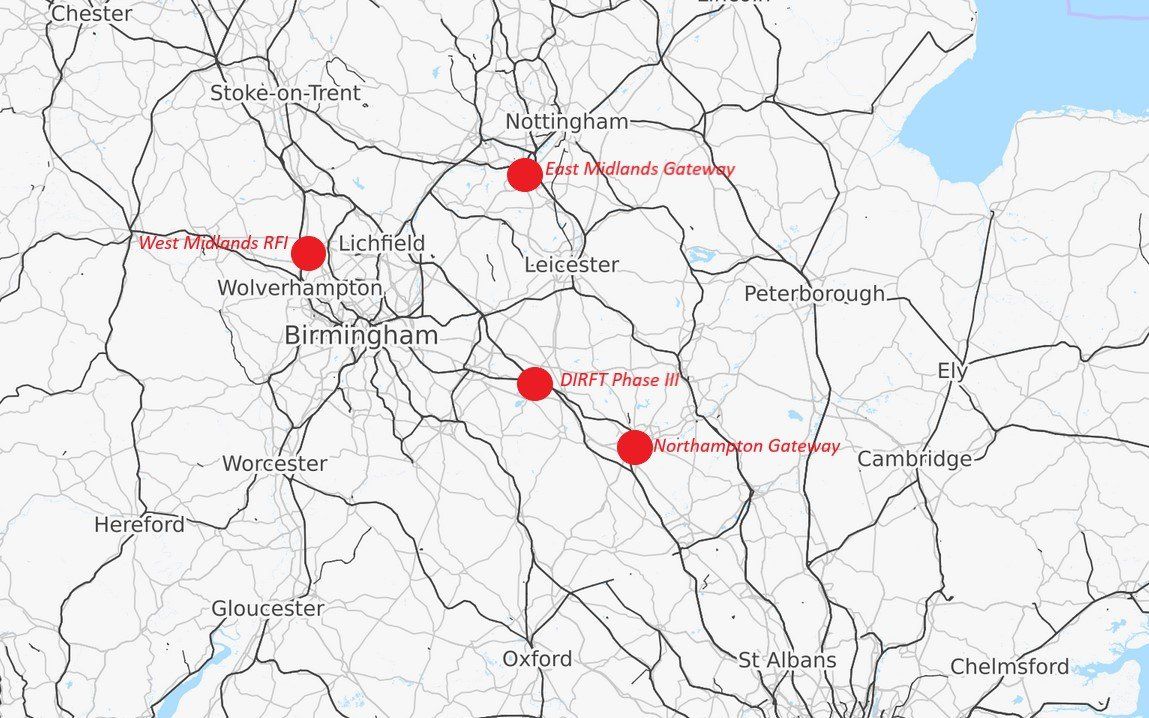

On 4 May 2020, the Secretary of State for Transport issued a Development Consent Order (DCO) granting planning permission for the West Midlands Rail Freight Interchange (WMRFI) , a new Strategic Rail Freight Interchange (SRFI) near Four Ashes in South Staffordshire. The development will provide for a new intermodal terminal connected to the West Coast Main Line capable of handling trains up to 775m length, alongside circa 745,000 square metres of modern logistics warehousing and other associated facilities.

The LOGISTAR project is seeking to develop a proof of concept software ‘tool’ to allow effective planning of transport operations in the supply chain through collaboration and using real-time data gathered from an interconnected environment. The project, which held its 4th plenary meeting in Vienna on 3-4 December 2019, has received funding from the EU’s Horizon 2020 Programme.

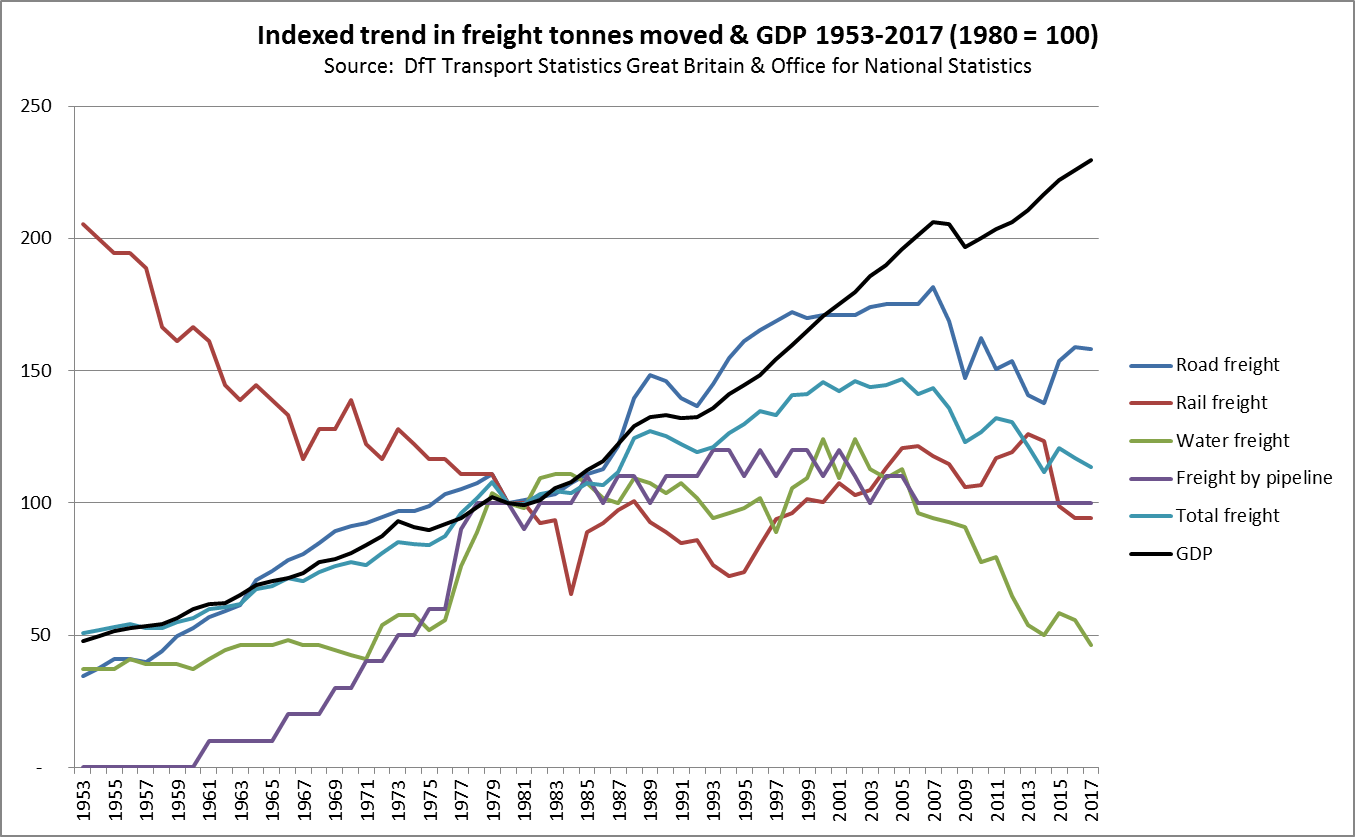

Rail freight in Great Britain appears, at first sight, to be in terminal decline. However, the rapid decline in coal traffic since 2013-14 as a result of energy policy has hidden the continuing success of the rail freight sector in handling more intermodal and construction traffic.

There has been a gradual de-coupling of freight moved or lifted from GDP growth since the early 1980s due to the decline of heavy industry and manufacturing generally and a shift to a service-based economy that is more reliant on imports of consumer goods. This trend accelerated following the Great Recession in 2008-09.